New Data Finds Negative Equity and Consumer Debt Declining

A pair of new reports has determined an improving economic picture for homeowners and the wider U.S. economy.

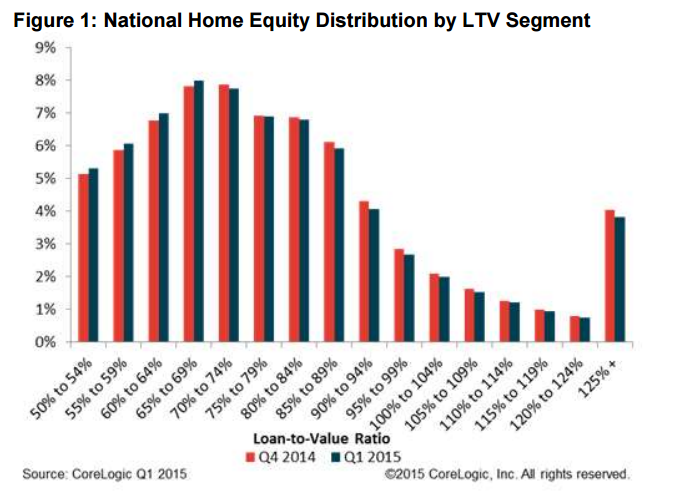

The latest CoreLogic study on negative equity found 254,000 properties regained equity in the first quarter, bringing the total number of mortgaged residential properties with equity at the end of the quarter to 90 percent of all mortgaged properties. On a national level, CoreLogic found borrower equity increased year over year by $694 billion in the first quarter.

The total number of mortgaged residential properties with negative equity is now placed at 5.1 million, or 10.2 percent of all mortgaged properties. This is down from 5.4 million homes, or 10.8 percent, that had negative equity in the fourth quarter of 2014 and down from 6.3 million homes, or 12.9 percent, reported in the first quarter of last year.

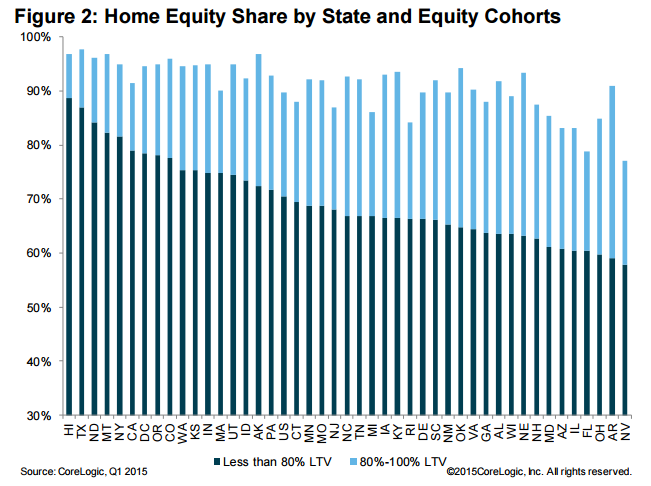

Texas had the highest percentage of mortgaged residential properties in positive equity at 97.7 percent, followed by Hawaii (96.9 percent), Alaska (96.8 percent), Montana (96.8 percent) and North Dakota (96.2 percent). On the flip side, Nevada had the highest percentage of mortgaged residential properties in negative equity at 23.1 percent, followed by Florida (21.2 percent), Illinois (16.8 percent), Arizona (16.8 percent) and Rhode Island (15.7 percent). Combined, these five states accounted for 31.4 percent of U.S. negative equity.

“Many homeowners are emerging from the negative equity trap, which bodes well for a continued recovery in the housing market,” said Anand Nallathambi, president and CEO of CoreLogic. “With the economy improving and homeowners building equity, albeit slowly, the potential exists for an increase in housing stock available for sale, which would ease the current imbalance in supply and demand.”

Separately, the latest S&P/Experian Consumer Credit Default Indices reported historical lows for four of the five national indices. The composite index posted its second consecutive historical low of 0.88 percent in May, a decrease of nine basis points, while the first mortgage default rate was down nine basis points to 0.74 percent and the second mortgage default rate down one basis point to 0.42 percent. The auto loan default rate also reported a historical low of 0.86 percent, a decrease of eight basis points. While not a historic low, the bank card default rate reported its first decrease since January 2015 with a rate of 2.98 percent with a drop of 20 basis points, its largest reported decline since October 2013.

David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices, presented the data as evidence of a recovering environment for homeownership.

“These figures are another indication that housing is recovering,” he said. “Moreover, other data on financial difficulties confirm that foreclosures are declining and consumers’ capability and willingness to borrow are improving.”