New Data Finds Mixed Picture on Rates and Foreclosures

The latest housing data continued to see-saw between developments that inspired optimism and numbers that are not entirely copacetic.

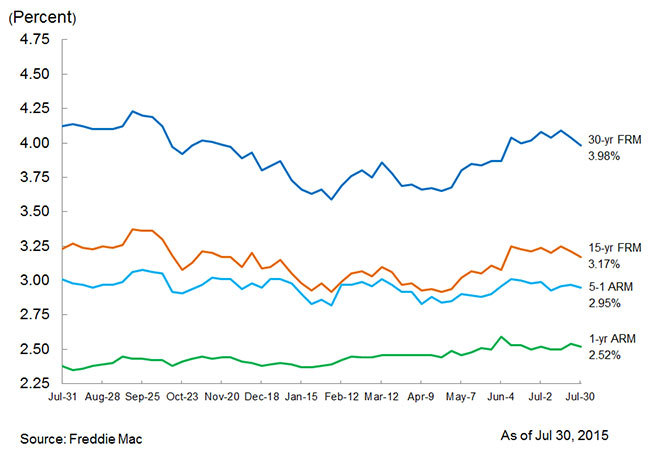

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) found the 30-year fixed-rate mortgage (FRM) averaging 3.98 percent with an average 0.6 point for the week ending July 30, down from last week when it averaged 4.04 percent. The 30-year FRM averaged 4.12 percent at this time in 2014. The 15-year FRM this week averaged 3.17 percent with an average 0.6 point, down from last week’s 3.21 percent and last year’s 3.23 percent.

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.95 percent this week with an average 0.4 point. It averaged 2.97 percent last week and 3.01 percent last year. And the one-year Treasury-indexed ARM averaged 2.52 percent this week with an average 0.3 point, down from 2.54 percent last week and 2.38 percent last year.

Sean Becketti, chief economist at Freddie Mac, could not forecast a stronger near-future.

“With no clear direction coming from the Fed this afternoon, we expect more of the same in coming weeks,” Sean Becketti said, pointing to new data reports showing weakness in new home sales and pending home sales along with lower-than-expected house price numbers via the S&P/Case-Shiller indices.

Still, not everything was uncertain.

The Federal Housing Finance Agency (FHFA) announced that the average interest rate on all mortgage loans in June was 3.85 percent, up 10 basis points (bps) from 3.75 in May, while the average interest rate on conventional, 30-year FRMs of $417,000 or less was 4.04 percent, an increase of 14 bps from 3.90 in May. The effective interest rate on all mortgage loans was 3.99 percent in June, up nine bps from 3.90 percent in May, and the average loan amount for all loans was $325,600 in May, up $14,700 from $310,900 in May.

On the other hand, somewhat unsettling data from RealtyTrac found more 7.4 million residential properties, or 13.3 percent of all properties with a mortgage, where seriously underwater in the second quarter, up slightly from the 13.2 percent level in the first quarter. This is the second consecutive quarter where the quantity of seriously underwater properties increased.

However, the share of distressed properties—those in some stage of the foreclosure process—that were seriously underwater at the end of the second quarter was 34.4 percent, down from 35.1 percent in the first quarter and down from 43.6 percent in the second quarter of 2014, to the lowest level since tracking began in the first quarter of 2012. But, the share of foreclosures with positive equity increased to 42.4 percent in the second quarter, up slightly from 42.1 percent in the first quarter and up from 34.1 percent in the second quarter of 2014.

“Slowing home price appreciation in 2015 has resulted in the share of seriously underwater properties plateauing at about 13 percent of all properties with a mortgage,” said Daren Blomquist, vice president at RealtyTrac. “However, the share of homeowners with the double-whammy of seriously underwater properties that are also in foreclosure is continuing to decrease and is now at the lowest level we’ve seen since we began tracking that metric in the first quarter of 2012.”