Pending Home Sales, Rates Drop

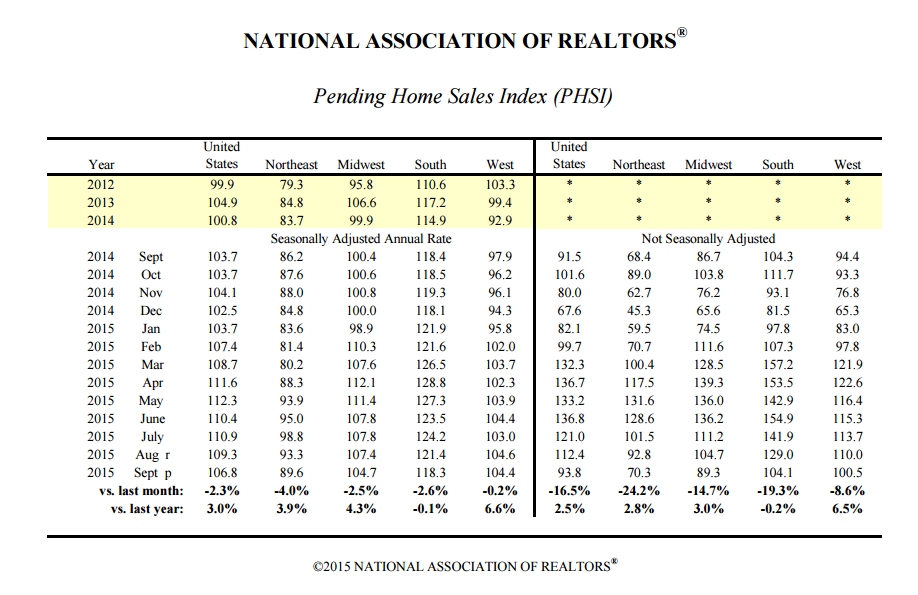

The Pending Home Sales Index (PHSI), published by the National Association of Realtors (NAR), registered 106.8 in September, the second lowest level this year. September’s level was a 2.3 percent slip from the slightly downwardly revised 109.3 in August but a three percent spike from 103.7 level in September. The index registered month-over-month declines in the Northeast, South and Midwest, with the West managing a miniscule 0.2 increase.

“There continues to be a dearth of available listings in the lower end of the market for first-time buyers, and Realtors in many areas are reporting stronger competition than what’s normal this time of year because of stubbornly-low inventory conditions,” said NAR Chief Economist Lawrence Yun. “Additionally, the rockiness in the financial markets at the end of the summer and signs of a slowing U.S. economy may be causing some prospective buyers to take a wait-and-see approach.”

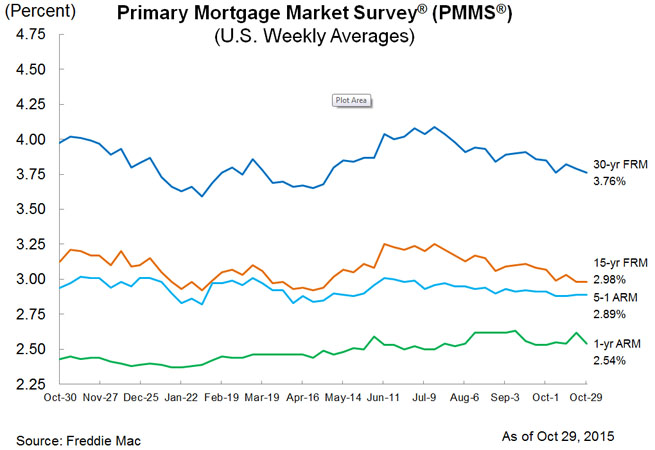

While pending home sales fell, so did mortgage rates. The new Freddie Mac Primary Mortgage Market Survey (PMMS) for the week ending Oct. 29 found the 30-year fixed-rate mortgage (FRM) averaged 3.76 percent with an average 0.6 point, down from last week’s 3.79 percent average and down from the 3.98 percent average of a year ago. The 15-year FRM this week averaged 2.98 percent with an average 0.6 point, unchanged from last week and below the 3.13 percent average of a year ago.

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.89 percent this week with an average 0.4 point, unchanged from last week and below the 2.94 percent average of last year. And the one-year Treasury-indexed ARM averaged 2.54 percent this week with an average 0.2 point, down from 2.62 percent last week but above the 2.43 percent of last year.

"Treasury yields oscillated without a clear direction heading into the October FOMC meeting, as investors were confident there would be no rate increase,” said Sean Becketti, chief economist at Freddie Mac, referring to the policy-setting arm of the Federal Reserve. “While the FOMC left rates unchanged at this meeting, they kept a December rate hike as an option causing Treasuries to sell off in the latter part of the day, after our survey closed."