Share of U.S. Homes Flipped in Q3 Rises Nearly 20 Percent Year-Over-Year

RealtyTrac has released its Q3 2015 U.S. Home Flipping Report, which shows that 43,197 single-family homes and condos were flipped—sold as part of an arms-length sale for the second time within a 12-month period—in the third quarter of 2015, five percent of all single-family home and condo sales during the quarter.

The five percent share in the third quarter was down seven percent from a 5.4 percent share in the second quarter but up 18 percent from a 4.3 percent share in the third quarter of 2014—when the share of U.S. homes flipped hit the lowest quarterly level going back to the first quarter of 2000, the earliest RealtyTrac has data on flipped homes.

“After curtailing flipping activity last year due to slowing home price appreciation and shrinking inventory of flip-worthy homes, real estate investors have started to jump back on the flipping bandwagon in 2015,” said Daren Blomquist, vice president at RealtyTrac. “On the acquisition side, investors are finding creative ways to pinpoint potential flips in the off-market arena, and on the disposition side investors have a bigger pool of potential buyers thanks to a surge in FHA buyers this year, many of them first-time buyers looking for starter homes.”

The average gross flipping profit—the difference between the purchase price and the flipped price (not including rehab costs and other expenses incurred, which flipping experts estimate typically run between 20 percent and 33 percent of the property’s after repair value)—was $62,122 for completed home flips in the third quarter. That was down slightly from an average gross flipping profit of $62,521 in the second quarter but up slightly from an average gross flipping profit of $61,781 in the third quarter of 2014.

The average gross return on investment (ROI)—the average gross profit as a percentage of the average original purchase price—was 33.8 percent for completed home flips in the third quarter, down from 34.4 percent in the previous quarter but up from 32.7 percent in the third quarter of 2014.

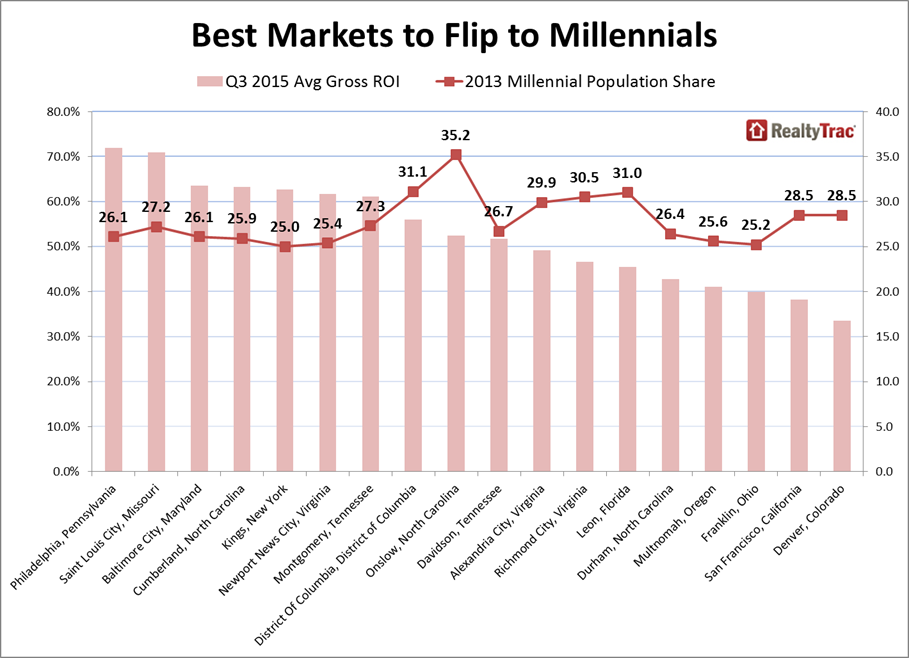

Using data from the third quarter flipping report and U.S. Census demographic data, RealtyTrac identified 18 counties where the average gross return on a flipped home in the third quarter was at least 30 percent and where the millennial share of the population in 2013 (defined as those between the ages of 20 and 34 in 2013) was at least 25 percent and increased during the housing downturn between 2008 and 2013.

The top five counties for flipping to millennials were Philadelphia County, Pennsylvania, Saint Louis City, Missouri, Baltimore City, Maryland, Cumberland County, North Carolina—in the Fayetteville area—and Kings County, New York—Brooklyn. All five of these counties had average gross flipping profits in the third quarter of 63 percent or more.

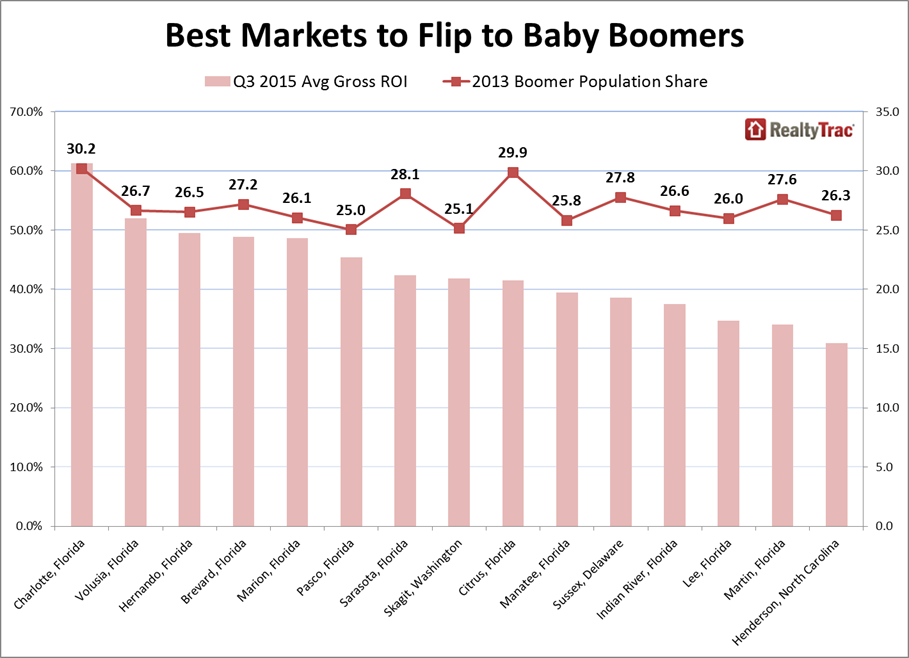

RealtyTrac identified 15 counties where the average gross return on a flipped home in the third quarter was at least 30 percent and where the baby boomer share of the population in 2013 (defined as those between the ages of 49 and 67 in 2013) was at least 25 percent and increased between 2008 and 2013.

The top five counties for flipping to boomers were all in Florida: Charlotte and Hernando counties in southwest Florida, and Volusia, Brevard and Marion counties in central Florida. The only counties outside of Florida on the top 15 list for flipping to boomers were Skagit County, Washington between Seattle and Vancouver; Sussex County, Delaware, on the Atlantic Coast between Washington, D.C. and Philadelphia;and Henderson County, North Carolina in the Asheville metro area.