Negative Equity Retreats, Loan Performance Strengthens

The third quarter was a great three-month stretch for the mortgage world, according to a pair of new data reports.

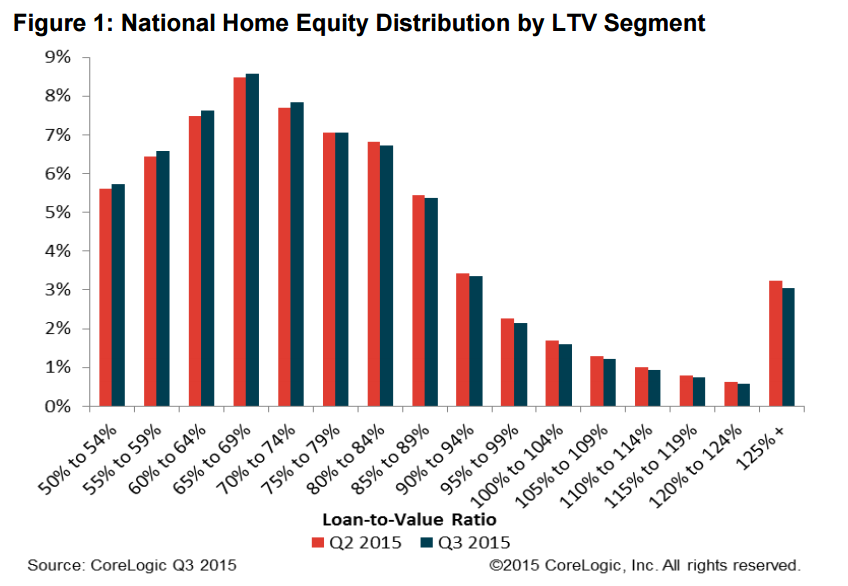

CoreLogic’s latest data analysis has determined that 256,000 properties regained equity in the third quarter. As of Sept. 30, 92 percent of all home with an outstanding mortgage—roughly 46.3 million residences—had positive equity. Furthermore, borrower equity grew by $741 billion on a year-over-year measurement.

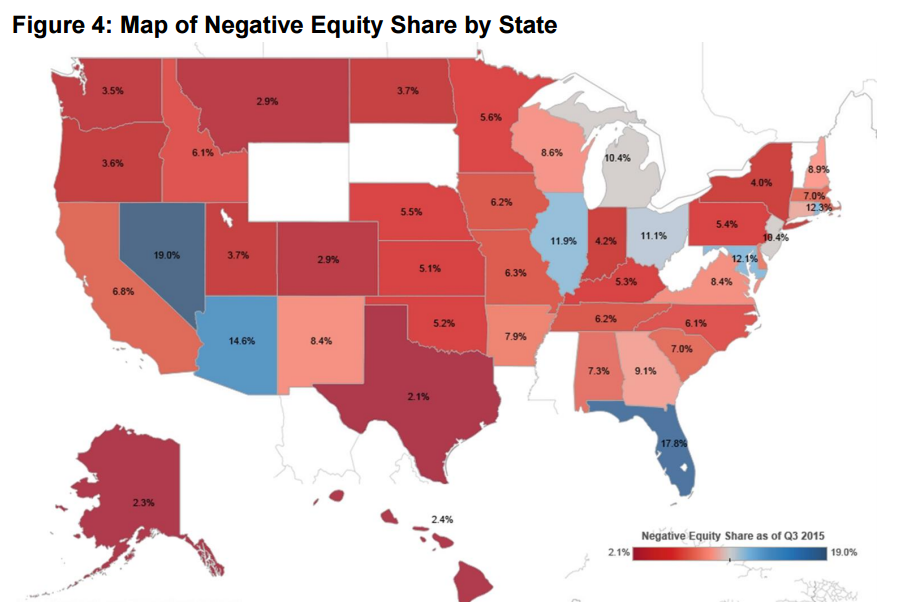

Still, approximately 4.1 million carried negative equity through the third quarter. But that level was down 4.7 percent from the second quarter and down 20.7 percent from the third quarter of 2014. The national aggregate value of negative equity was $301 billion as of Sept. 30.

Nevada had the highest percentage of mortgaged residential properties in negative equity at 19 percent, followed by Florida (17.8 percent), Arizona (14.6 percent), Rhode Island (12.3 percent) and Maryland (12.1 percent). These five states accounted for nearly 30 percent of all of the negative equity in the U.S. On the flip side, Texas had the highest percentage of mortgaged residential properties in positive equity at 97.9 percent, followed by Alaska (97.7 percent), Hawaii (97.6 percent), Colorado (97.2 percent) and Montana (97.1 percent). Arizona’s Phoenix-Mesa-Scottsdale corridor had the highest metro market percentage of mortgaged residential properties in negative equity at 14.2 percent.

“Homeowner equity is the largest source of wealth for many Americans,” said Anand Nallathambi, president and CEO of CoreLogic. “The rise in home prices, expected to be at least five percent in 2016, will continue to build wealth and confidence across America. As this process continues, it will provide support for the housing market and the broader economy throughout next year.”

Separately, the Office of the Comptroller of the Currency’s (OCC) quarterly report on mortgages has found that 93.9 percent of mortgages that fall under this regulator’s authority—roughly 42 percent of all U.S. mortgages—were current and performing at the end of the quarter, up 0.9 percent from the third quarter of 2014.

The percentage of mortgages that were 30 to 59 days past due was 2.3 percent of the portfolio, a 4.4 percent decrease from a year earlier, while seriously delinquent mortgages were 2.6 percent of the portfolio, a 16.1 percent decrease from a year earlier.

The OCC also found that servicers at financial institutions under its regulatory authority initiated 64,156 new foreclosures during the third quarter, down from 82,668 a year earlier. The number of mortgages in the process of foreclosure at the end of the third quarter was 269,751, a 23.8 percent year-over-year decline. The percentage of mortgages within this portfolio that were in the process of foreclosure at the end of the third quarter was a relatively scant 1.2 percent.