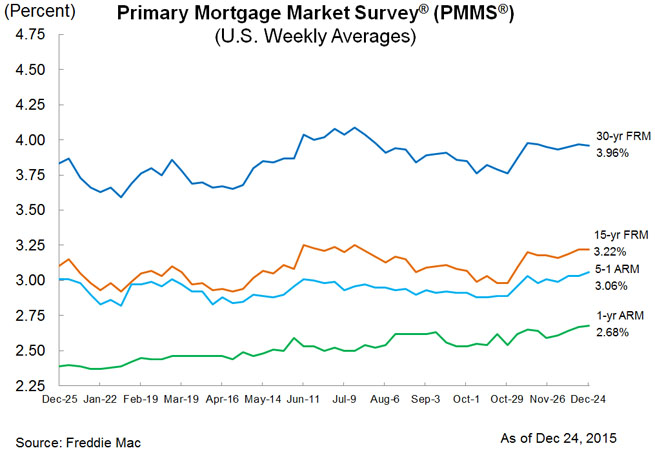

Mortgage Rates Flatten as 2015 Comes to a Close

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing fixed-rate mortgages (FRMs) largely unchanged heading into the holiday weekend, as the 30-year FRM averaged 3.96 percent, with an average 0.6 point for the week ending Dec. 24, 2015, down from last week when it averaged 3.97 percent. A year ago at this time, the 30-year FRM averaged 3.83 percent. The 15-year FRM averaged 3.22 percent this week, with an average 0.6 point, unchanged from last week. A year ago at this time, the 15-year FRM averaged 3.10 percent.

"Treasury yields dropped slightly as the holidays approach," said Sean Becketti, chief economist, Freddie Mac. "Mortgage rates remain largely unchanged, with the 30-year mortgage rate ticking down a basis point to 3.96 percent. As we mentioned last week, long-term interest rates will not spike in response to the Federal funds rate increase. While we expect the 30-year mortgage rate to be above four percent in early 2016, we anticipate rates will gradually increase, averaging 4.4 percent for the year."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.06 percent this week with an average 0.4 point, up from last week when it averaged 3.03 percent. A year ago, the five-year ARM averaged 3.01 percent. The one-year Treasury-indexed ARM averaged 2.68 percent this week with an average 0.2 point, up from 2.67 percent last week. At this time last year, the one-year ARM averaged 2.39 percent.