Mortgage Rates and Availability Take a Tumble

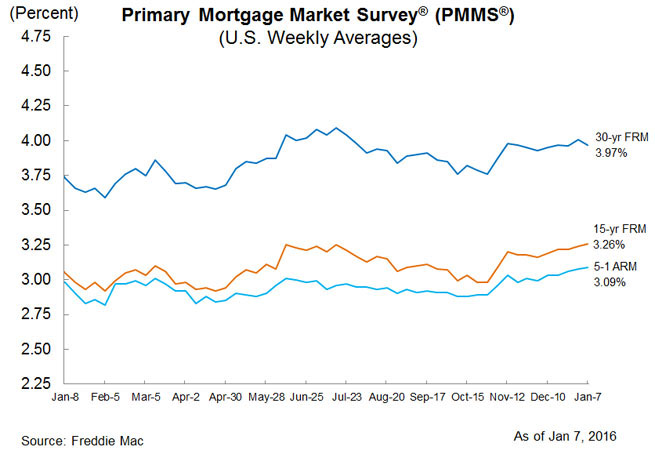

After ending 2015 above the four percent mark, mortgage rates returned in 2016 to too-familiar anemic territory.

According to the latest Primary Mortgage Market Survey (PMMS) from Freddie Mac, the 30-year fixed-rate mortgage (FRM) averaged 3.97 percent this week, down from last week’s 4.01 percent. Still, it is above the 3.73 percent average from a year ago. The 15-year FRM this week averaged 3.26 percent, up from last week’s 3.24 percent and last year’s 3.05 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.09 percent this week, slightly higher from last week’s 3.08 percent and above last year’s 2.98 percent.

Sean Becketti, chief economist at Freddie Mac, blamed the latest numbers on external factors.

“Concerns about overseas economic developments have dominated financial markets to start the year,” Becketti said. “U.S. Treasury bond yields fell amidst a global equity selloff and flight to safety. In response, the 30-year mortgage rate dipped four basis points to 3.97 percent.”

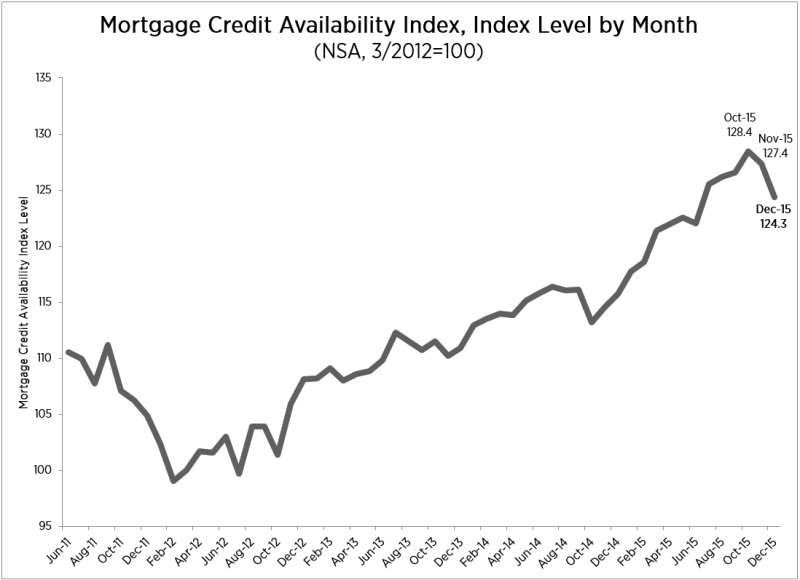

Separately, the Mortgage Bankers Association (MBA) reported that its’ Mortgage Credit Availability Index (MCAI) declined by 2.4 percent to a level of 124.3 in December. Three of the four component indices took a tumble last month–the Conventional MCAI was down 4.8 percent, the Jumbo MCAI fell 4.2 percent and the Government MCAI ticked downward by 0.6 percent–with only the Conforming MCAI increasing, albeit by a scant 0.1 percent.

Lynn Fisher, MBA’s vice president of research and economics, blamed the dreary data on a “technical issue related to implementation of affordable, low down payment, loan programs.”