New Housing Data Points to Financial Stability and Maturity

The mortgage delinquency rate fell 28 percent on a year-over-year measurement during the fourth quarter of 2015, according to new data from TransUnion. The drop from 3.29 percent the fourth quarter of 2014 go 2.37 percent in the fourth quarter of 2015 was largest year-over-year decline that TransUnion has recorded for a fourth quarter since the mortgage delinquency rate began to recover in 2010.

Simultaneously, mortgage debt per borrower increased 1.4 percent from $187,139 in the fourth quarter of 2014 to $189,707 in the fourth quarter of 2015—the highest debt level per borrower since TransUnion began tracking this statistic in 2009.

“The rapid decline in the mortgage delinquency rate and the rise in mortgage debt is a positive sign for the residential real estate market,” said Joe Mellman, vice president and mortgage business leader for TransUnion. “Newer vintage loans continue to perform well and borrowers are receiving larger loans on their home purchases. While the total number of mortgage accounts dropped by nearly one million last year, we attribute much of this decline from delinquent mortgage borrowers concluding the foreclosure process and no longer being represented in the overall numbers.”

Separately, a new survey conducted by TD Bank points to a new era in homeowner optimism. According to a survey of approximately1,350 homeowners for TD Bank's inaugural Home Equity Sentiment Index, 56 percent of respondents asserted their home's value has increased. Sixty percent of respondents said they would tap that rising equity to finance renovations, while 53 percent of Millennial homeowners affirmed they were open to such a move. As for renovation projects, most respondents were eager to upgrade their kitchens (42 percent), with bathrooms (25 percent) and other household projects (11 percent) taking a lower priority.

"Consumers have been reluctant to start home renovations in recent years because of all the uncertainties in the economy," said Mike Kinane, senior vice president of Home Equity for TD Bank. "It's encouraging to see a growing appetite for these projects."

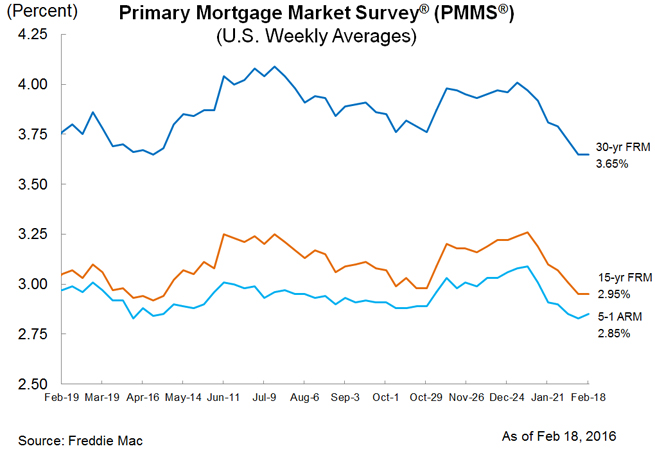

As for mortgage rates, this week was the first in 2016 when rates did not decline.

This week’s Freddie Mac Primary Mortgage Market Survey (PMMS) found the 30-year fixed rate mortgage (FRM) averaging 3.65 percent and the 15-year FRM averaging 2.95 percent, both unchanged from the previous week. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.85 percent this week, up slightly from last 2.83 percent.