HOPE NOW: 1.45M Foreclosure Alternative Solutions in 2015

Last year saw that 1.45 million homeowners receive a foreclosure alternative solution, according to year-in-review data released by the HOPE NOW industry alliance.

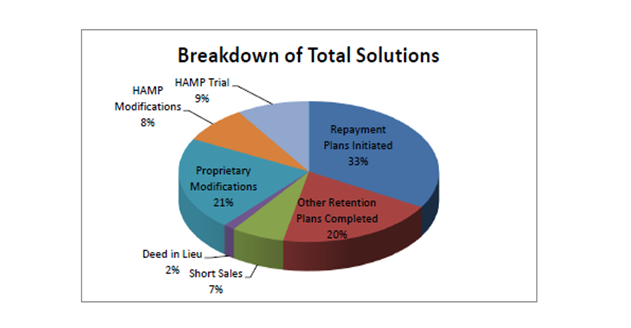

The industry offered approximately 420,000 permanent loan modifications during 2015, of 302,000 were proprietary and 117,267 were completed under the Home Affordable Modification Program (HAMP).

HOPE NOW reported there were 705,000 foreclosure starts in 2015, down 16 percent from the 842,000 in 2014, and approximately 342,000 completed foreclosure sales were in 2015, down 25 percent from the 455,000 in 2014. Approximately 86,000 short sales and almost 20,000 deeds in lieu were also completed last year.

“The 2015 data report affirms the recent trends in housing market recovery,” said Erik Selk, executive director of HOPE NOW. “Delinquency and foreclosure data continues to decrease and approach pre-crisis norms … Just six years ago, we were at the apex of the foreclosure crisis with over 4.1 million homeowners in serious delinquency and today, we are at 1.6 million. This is a true testament to the recovery and all the hard work that HOPE NOW members have maintained to assist those in need.”