A Copacetic Data Day for Housing

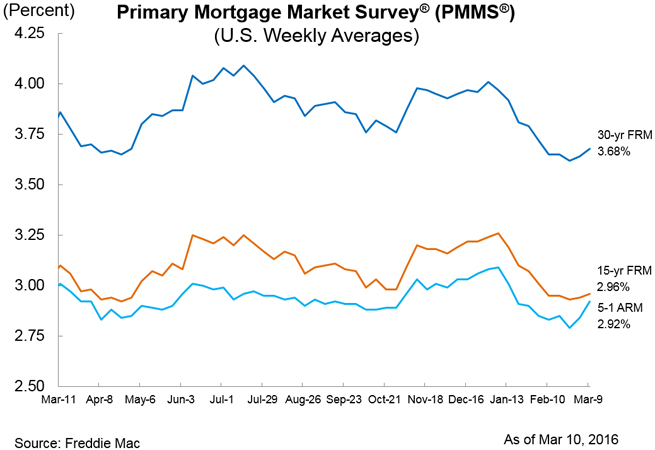

For the second consecutive week, mortgage rates were on the rise. Freddie Mac’s Primary Mortgage Market Survey (PMMS) reported that the 30-year fixed-rate mortgage (FRM) averaged 3.68 percent for the week ending March 10, up from last week’s 3.64 percent, while the 15-year FRM this week averaged 2.96, up from last week when it averaged 2.94 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.92 percent this week, up from last week when it averaged 2.84 percent.

There was more positive news via the Mortgage Bankers Association (MBA) Builder Application Survey (BAS), which found mortgage applications for new home purchases in February increased by 24 percent relative to the previous month. The average loan size of new homes increased from $325,806 in January to $328,370 in February. The MBA estimated new single-family home sales were at a seasonally adjusted annual rate of 544,000 units in February; on an unadjusted basis, the MBA put the number closer to 47,000 new home sales, an increase of 23.7 percent from 38,000 new home sales in January.

“Mortgage applications to homebuilder affiliates increased across the board in our survey for February as continued low interest rates and fairly mild weather helped to kick off the spring buying season,” said Lynn Fisher, MBA’s vice president of research and economics. “Our estimate of new single family home sales for February comes in at 544,000 on a seasonally adjusted basis, nearly 12 percent above February a year ago.”

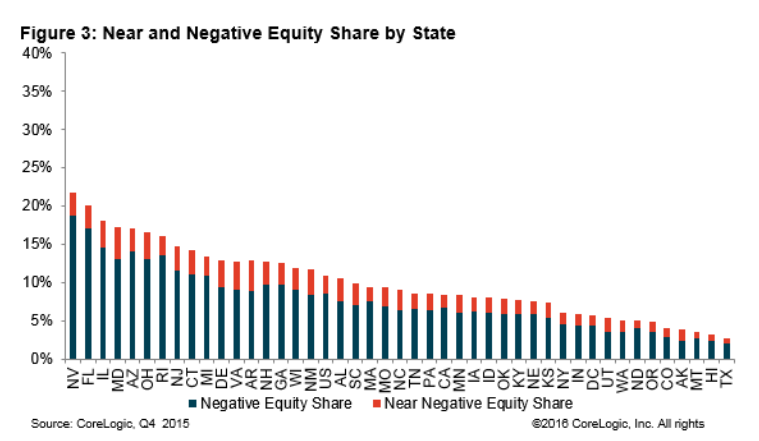

In other developments, CoreLogic reported that one million borrowers regained equity in 2015. As a result, 2015 closed with positive equity on 91.5 percent—roughly 46.3 million—of all mortgaged properties

Alas, there was a sliver of bad news in CoreLogic’s numbers: the total number of mortgaged residential properties with negative equity stood at 4.3 million, or 8.5 percent, in the fourth quarter of 2015, up 2.9 percent from the previous quarter—but dramatically down 19.1 percent from the fourth quarter of 2014.

"The number of homeowners with more than 20 percent equity is rising rapidly," said Anand Nallathambi, president and CEO of CoreLogic. "Higher prices driven largely by tight supply are certainly a big reason for the rise, but continued population growth, household formation and ultralow interest rates are also factors. Looking ahead in 2016, we expect home equity levels to continue to build, which is a good thing for the long-term health of the U.S. economy."