Mortgage Rates Take a Dip

Well, it couldn’t last forever …

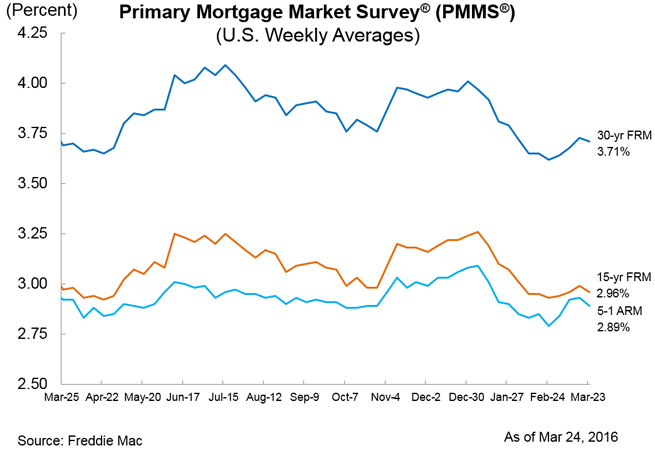

After three consecutive weeks of increases, mortgage rates declined, according to the Freddie Mac Primary Mortgage Market Survey (PMMS) for the week ending March 24.

The 30-year fixed-rate mortgage (FRM) averaged 3.71 percent this week, down from last week’s 3.73 percent and higher than the 3.69 percent level from one year ago. The 15-year FRM this week averaged 2.96 percent, below last week’s 2.99 percent and last year’s 2.97 percent. And the 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.89 percent this week, a drop from last week’s 2.93 percent and last year’s 2.92 percent.

Sean Becketti, chief economist Freddie Mac, blamed the rate drop on Janet Yellen and friends.

"The Federal Reserve's decision last week to maintain the current level of the Federal funds rate combined with the reduction in their forecast for growth triggered a three-basis point drop in the 10-year Treasury yield,” Becketti said. “As a consequence, the 30-year mortgage rate declined two basis points to 3.71 percent. However, comments this week by several members of the Fed, including the presidents of the Richmond, San Francisco, and Atlanta banks, indicated that a June rate hike is still on the table."