Loan Application Defect Index Shows Uptick

There was an increased level of problematic lending inquiries last month, according to the latest First American Loan Application Defect Index report.

This Index increased 1.3 percent in March over the previous, the first uptick since July 2015, but it was down by 2.6 percent as compared with March 2015. The Defect Index for refinance transactions upticked 1.5 percent month-over-month but was 5.7 percent lower than a year ago. The Defect Index for purchase transactions increased 1.2 percent month-over-month, but was 3.4 percent below the March 2015 level.

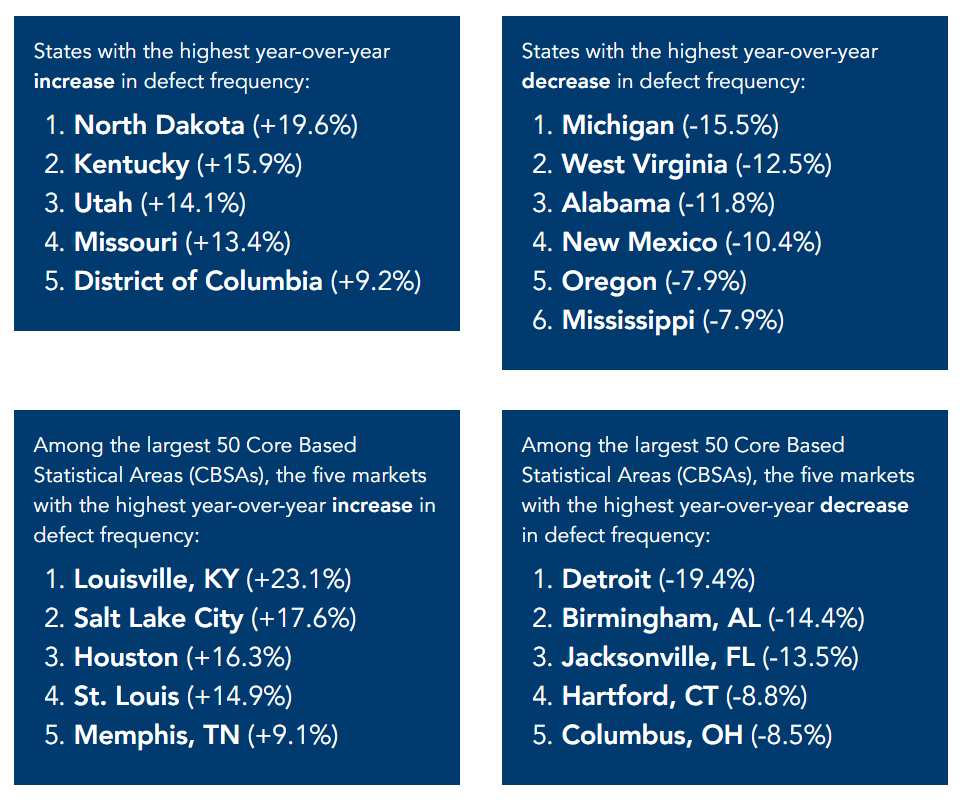

The five states with the highest year-over-year increase in defect frequency in March are North Dakota (19.6 percent), Kentucky (15.9 percent), Utah (14.1 percent), Missouri (13.4 percent) and the District of Columbia (9.2 percent). The five largest metro markets with the highest year-over-year increase in defect frequency are Louisville (23.1 percent), Salt Lake City (17.6 percent), Houston (16.3 percent), St. Louis (14.9 percent) and Memphis (9.1 percent).

“While February 2016 is now the new low point for the index, it’s too early to know if the increase in misrepresentation and fraud risk in March is the beginning of a long-term upward trend or a short-term adjustment,” said Mark Fleming, chief economist at First American. “One possibility for the reversal of direction is the month-over-month increase in risk among Federal Housing Administration (FHA), Veterans Administration, and United States Department of Agriculture loans. The defect risk for these loan transaction types increased 1.4 percent from February to March, as opposed to conventional loans that had no change month-over-month. The share of FHA mortgage originations increased after a reduction in the premium last year, making them relatively more competitive for borrowers with low downpayments and low credit scores, which also typically have higher defect risk.”