Step Inside Ginnie Mae: New Market Reality

The housing finance industry is continuing to evolve, and during this evolution, the role of Ginnie Mae is more critical than ever. In recent months, Ginnie Mae has become the first source of new mortgage-backed securities (MBS) with one-third of the overall market share, and we are rapidly closing in on $1.7 trillion in outstanding Ginnie Mae securities. This is important since we are committed to bringing our program to as many people as possible.

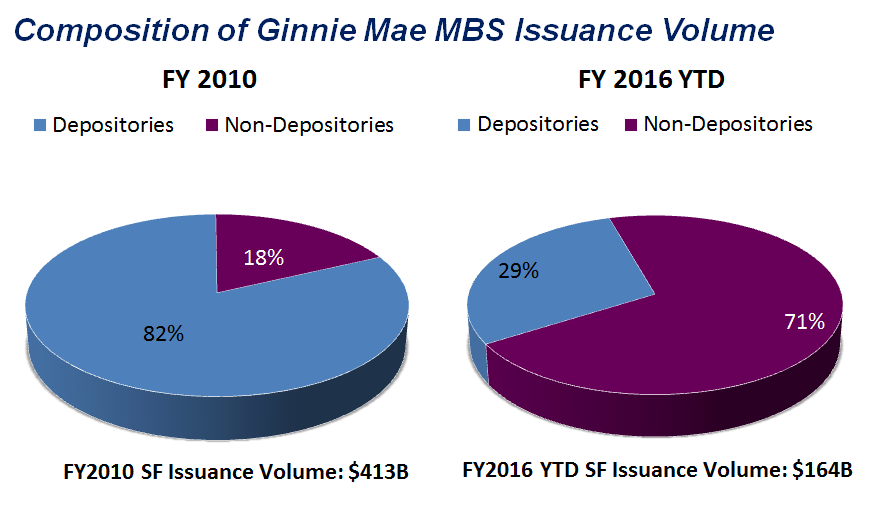

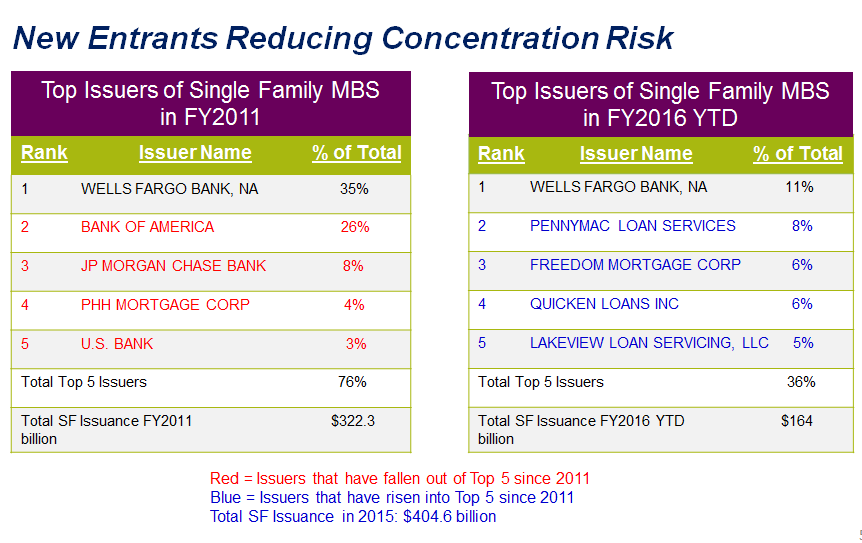

New Issuers and new borrowers coming into the Ginnie Mae program are opening up the credit access box. Ginnie Mae’s Issuer composition is almost completely opposite from six years ago.

Now, only one Issuer in Ginnie Mae’s top five is a traditional depository institution. Independent mortgage bankers are critical to sustaining consumer access to government-insured mortgages and insuring credit access for all.

Given this new market reality, Ginnie Mae is committed to ensuring the success of our Issuers as well as bringing our program to as many people as possible.

Ted W. Tozer is was sworn in as president of Ginnie Mae on Feb. 24, 2010, bringing with him more than 30 years of experience in the mortgage, banking and securities industries. As president of Ginnie Mae, Tozer actively manages Ginnie Mae's $1.5 trillion portfolio of mortgage-backed securities (MBS) and more than $460 billion in annual issuance.

This article originally appeared in the April 2016 print edition of National Mortgage Professional Magazine.