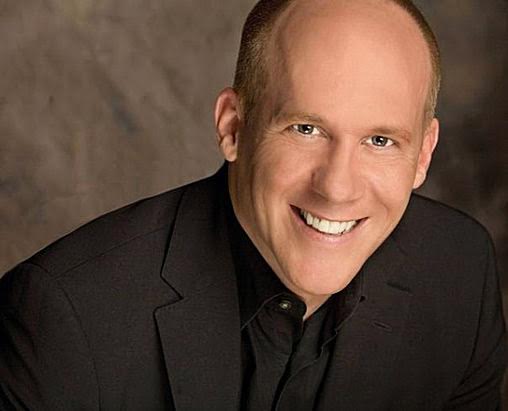

Featured Industry Leader: Scott Griffin, Statewide President, California Association of Mortgage Professionals

Scott Griffin began his career 30 years ago a residential property specialist leasing and managing large luxury apartment communities for real estate investment management firms. In 2003, he opened his self-named mortgage broker company, and is currently president-elect of the California Association of Mortgage Professionals (CAMP). National Mortgage Professional Magazine spoke with him about CAMP’s role in the California mortgage industry.

Scott Griffin began his career 30 years ago a residential property specialist leasing and managing large luxury apartment communities for real estate investment management firms. In 2003, he opened his self-named mortgage broker company, and is currently president-elect of the California Association of Mortgage Professionals (CAMP). National Mortgage Professional Magazine spoke with him about CAMP’s role in the California mortgage industry.

How and why did you get involved with the California Association of Mortgage Professionals (CAMP)?

In 2010 and 2011, the loan officer compensation rule was being rolled out. I had not been to a CAMP meeting in a while, but felt it was time to go back. I had a choice: I could either stand by or participate in the process.

After that meeting, I was invited to travel to Washington, D.C. with CAMP to discuss this issue with legislators. California is the only state that had lobbyists on Capitol Hill. I met with all of our legislators, and they wanted to learn how to get it right. Shortly after, bills were being written that benefited our industry.

When I was able to witness to power of change that was possible through the association, I knew I had better continue to show up and become an active part of CAMP.

Why do you feel members of the mortgage profession in California should join CAMP?

You get results. It is the power to keep your doors open.

And let’s not forget that CAMP works for consumers, too! This educational outreach is important because there are so many things happening now that must be understood. We are on the forefront of education, explaining how things work and don’t work. When we have an answer as to why things are happening, we are in a better position to explain it to our consumers.

Can you highlight the association’s role in the state legislative and regulatory environment?

Not only do we travel to Washington, D.C. as mentioned earlier, but we also go up to the state capitol in Sacramento. As bills are introduced, we make sure to review them and educate our state legislators on what these bills mean to mortgage professionals and to consumers.

We are fortunate to have incredible relationships with our state legislators. This year, we had a lot of our members go to Sacramento to speak with the legislators on the issues that are important to all of us.

Are you still making trips to Capitol Hill as well?

Are you still making trips to Capitol Hill as well?

I just got back from a trip to Washington at the NAMB Legislative & Regulatory Conference. I was sitting with members of Congress behind closed doors discussing HB 2121. If you start visiting with lawmakers and go a little bit deeper, they can see the other side of the same story and make better decisions.

Is there value in CAMP being a state affiliate of NAMB?

You bet there is! NAMB is an integral part of the industry. We view NAMB as a partner, and their success if very important to all of us.

In your opinion, what can be done to bring more young people into the mortgage profession?

It is always important to bring in fresh blood. We partnered with Ginger Bell to work with a new association called The Young Mortgage Professionals Association, which is seeking to bring more young people into the industry.

What is the housing market like in your area of California?

Here in Los Angeles, it is exploding. I’m hearing a lot of communities are experiencing high levels of multiple offers. People are trying so hard to get into homes that offers are going much higher than list prices.

Phil Hall is managing editor of National Mortgage Professional Magazine. He may be reached by e-mail at [email protected].