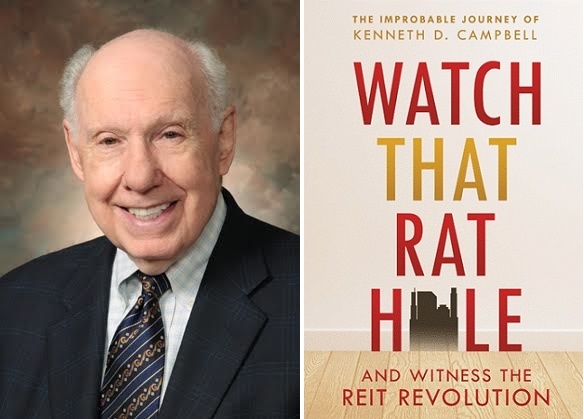

Kenneth D. Campbell: A Sweet REIT Life

Within the real estate investment trust (REIT) industry, Kenneth D. Campbell has rock star status. A one-time journalist, he founded Audit Investments Inc. in 1969 and merged the firm in 1992 into a new entity that became CBRE Clarion Securities, a global real estate securities firm now managing $20 billion in client assets. Campbell, at the age of 86, is still active as a managing director in the firm.

Campbell, who co-wrote the first full-length book on REITs with the 1971 offering The Real Estate Trusts: America’s Newest Billionaires, just published his newest book, the autobiography, Watch That Rat Hole: And Witness the REIT Revolution.

In an exclusive interview with National Mortgage Professional Magazine, Campbell looked back on his career in the REIT industry and offered his opinion on the state of the REIT world.

How would you categorize the state of today’s REIT industry?

Kenneth D. Campbell: Underlying real estate fundamentals are solid and equity REITs have room to grow longer-term as the economy expands and as new REITs enter the field. But the market for REIT stocks presents uncertainties that give me caution nearer-term. As we are discussing this (on July 26), equity REITs have risen 17.4 percent year-to-date, more than doubling the 7.4 percent gain for the Standard & Poor’s 500 Index.

I always become nervous when REITs outperform the broader market by such a wide margin. Right now, the market looks skittish to me, seeking negatives and punishing the stock of any company with small blemishes in earnings. So my caution relates to the market, not real estate fundamentals.

In terms of real estate operating fundamentals, demand seems strong while new supply is muted and the lowest in several decades in most property types, although demand appears more flattish in offices and apartments in some popular cities. The job outlook is key. The result is REIT occupancy at near-record levels of 95.5 percent, according to Citi Research, versus 93.2 percent average since 2001, pushing both rents and net operating income [NOI, or rents minus all direct property operating costs] again near record highs. In fact, real estate fundamentals are so strong historically that a number of stock market analysts are forecasting limited gains or moderate declines in coming quarters.

Some moderation from historically high performance levels seems possible to me in some sectors, but this should not upset the industry’s bull case. Rather, it should force investors to focus on the most efficient and best performing companies in the best markets and property types.

Offsetting this modest NOI growth potential are debt capital markets welcoming new financing at both attractive rates and loan-to-value ratios for quality properties.

“Interest rates should remain low for as far as the eye can see,” one savvy REIT executive told me recently. Commercial banks seem to be tightening lending standards slightly, but rates remain attractive. The default ratio is creeping upward in the commercial mortgage-backed securities [CMBS] market, but this market is still seeing healthy volumes. Equity capital is a strong point and most major equity REITs operate with much lower debt leverage than in the run-up to the 2007-2009 global financial crisis. Moreover, private investment entities have about $250 billion in funds sitting on the sidelines awaiting investment, all but assuring that cap rates will remain low for some time.

So, if both interest rates and cap rates remain low for the foreseeable future, it’s hard for me to see anything on the financial horizon that can upset the REIT apple cart. My fear is that any hiccup in earnings forecasts may be unduly punished by the market, which has an unforgiving laser focus on negatives right now. REITs are now priced at about 17-times forward earnings estimates, slightly below the multiple midpoint over the last 20 years and slightly higher than the S&P 500 Index (16.6X). These pale yellow lights mean stock selection is crucial and investors should consult their financial advisors.

REITs will grow in the years ahead, in my opinion. Offsetting the concerns outlined above is fact that real estate securities become a new asset class in the Global Industry Classification Standard [GICS] in September 2016. I see that event as the ultimate seal of approval because it’s certain to improve investor visibility and institutional acceptability for real estate securities. Hence it should bring more institutional money into equity REITs over the longer term, augmenting asset growth and, hopefully, longer-term investor returns.

So to answer your question: The outlook for equity REITs is solid with room to grow. A slight moderation in NOI could flatten growth but today’s litany of risks—Brexit impact, slowing China growth, possible GDP slowdown—seem manageable to me.

Within the REIT industry, which particular sectors do you forecast as having the greatest potential over the next 12 months?

Kenneth D. Campbell: Industrial REITs have been growing above average for several years now on the wings of the e-commerce revolution, and while this trend is well known among REIT investors, the June 2016 quarterly reports by several industrial REITs indicate—to my eyes, anyway—that demand for warehouse space by e-commerce operators is growing, if anything. Several industrial REITs say they are hearing from a wider range of e-commerce tenants with more urgent space needs.

My guess is that the industrial REITs do best over the next 12 months. One caution: Many in the REIT industry do not share my enthusiasm and an investor should consult his or her investment advisor before making any investment in industrial REITs because most are trading at historically high multiples. Past performance is no guarantee of future results.

The data center REITs have also been doing well recently but, again, multiples are elevated historically. Office REITs are priced at significant discounts to their underlying net asset values and provide well-covered dividends for longer-term investors.

Will the agitation created by Brexit and tumult about China’s economy bring more investors to REITs?

Kenneth D. Campbell: Brexit should focus more long-term investment capital on New York City, which competes with London as a world financial center. Large London-traded real estate REITs and companies sold off sharply on the Brexit vote but have recovered about two-thirds to three-fourths of their losses in the subsequent month. Also, uncertainty seems to have ended about the well-publicized failures of a few United Kingdom property funds (which owned both properties and securities) to honor redemption requests.

The London office market seems to have relatively low vacancy now and it’s likely some developers will postpone new office starts until the air clears. All that should work in favor of the New York City equity REITs. A half-dozen publicly traded equity REITs own more than 80 million square feet in Manhattan, or more than 20 percent of that market, so this is a very important market for REIT investors.

The tumult in China’s economy seems rooted in overbuilding in its housing market financed by aggressive monetary expansion to provide modern housing as a significant part of their population migrating from rural to urban areas. This over-building may take time to unwind, as it did in the U.S., slowing the global economy by an unknown amount. I do not see this as a near-term threat to U.S. REITs.

In creating your book, what were some of the toughest challenges in putting your life’s adventures on paper?

Kenneth D. Campbell: There were two challenges: The first challenge involved documenting times and events. One’s mind tends to romanticize and/or gloss over details of far-removed events. Luckily, I discovered my pack-rat tendencies had over-ridden good sense and I was able to resurrect many key documents from the past—more than half of my weekly calendars from 1969 onward, my letters seeking a job with House & Home Magazine (which form the basis for Chapter Five, “The March”), and my stock trading records between 1964 to 1969 when I learned the fundamentals of investing (Chapter Seven, “The Gestation”).

I thought my trading records had perished, but found them in a yellowed envelope. They let me document how I nearly tripled my H&H severance to give me the funds to begin my own business. I included details to the dollar in Appendix II because I hate investment books that tell tall tales of stock market gains without providing specifics.

Finally, I relied upon nearly every issue of my main investment advisory service, Realty Trust/Stock Review from March 1970 to June 1990, and they helped nail down countless facts. The University of Pennsylvania Libraries is digitizing their nearly 4,000 pages for use by scholars beginning in late 2017.

The second challenge involved the selection of stories to tell. Early on, I decided to tell all the notable stories I had been telling family and friends over the years, but that canon was so broad I had to focus on only the best. My first outline had something like 46 chapters, which I ultimately winnowed over several revisions to the 26 chapters forming the book. Along the way, I had been given a slim 20-page booklet titled Securities Admitted to Trading New York Real Estate Securities Exchange Inc. dated July 12, 1930, and I spent considerable time tracing the history of that ill-fated entity, largely through the digital files of The New York Times, to tell the story of this most significant precursor to equity REITs. The NYRESE story appears as Appendix I.

What do you see as your greatest accomplishment within the REIT industry?

Kenneth D. Campbell: When I began my advisory services in 1969, I found that Wall Street had little idea how properties were valued, and real estate people didn’t know how to value stocks. The problem was that accounting conventions required properties to be depreciated, creating sometimes-huge discrepancies between property values and their carrying values on company books. This kept stock market investors from knowing the true value of properties.

In Chapter 21 of Watch That Rat Hole, I tell the story of how one group of properties, valued at $2.42 per unit for historic accounting purposes in 1978, sold less than a year later at over $70 a unit—an astounding 29-times historic cost under accounting norms. I mounted an editorial campaign for transparency against such gross inequities, which put me on the outs with many subscribers. I debated this hot topic with the former president of the REIT trade association at the group’s 1979 annual meeting, and worked with other analysts to get accountants to change their rules and place true values on properties in their financial statements.

This formal change has never been adopted in the U.S. and investors now rely upon an informal system in which brokerage-firms provide their estimates of company net asset value (NAV). But outside the U.S., the International Financial Reporting Standards (IFRS) —which was primarily developed by accountants within the former British Empire (U.K., Australia, Canada)—requires companies to place current, or market, value on their properties in their financial statements. IFRS has been accepted by many foreign nations and, hopefully, the U.S. will adopt IFRS sometime down the line.

I also believe that I brought a new level of transparency and honesty to the industry, especially when discussing tender or unpleasant events such as property problems, activist investors, and shareholder returns. For many years we published very detailed analyses of fee arrangements for externally-managed REITs that helped, I believe, ultimately shift REITs from external to internal management, the industry norm today. My 1976 testimony to a Senate committee also forwarded this cause.

What advice would you give to today’s young people about working in the REIT industry?

Kenneth D. Campbell: Opportunity always comes dressed in overalls or cap-and-gown and carrying a book bag, so anyone wanting a career in real estate or the REIT industry should expect to learn and work hard. Here are some of my thoughts on this question:

►Acquire a broad view of real estate and the REIT industry. The National Association of Real estate Investment Trusts (NAREIT) has an excellent Web site loaded with helpful articles and news.

►Pursue an advanced education early in life before children arrive. I broke this rule and didn’t pursue an MBA until my children were in high school. My book is my way of telling my children what I was doing during their growing-up years.

►Learn the stock market. I list several books that helped me become comfortable in the stock market. Your reading list will vary. Learn math and finance and read about behavioral finance and the difference between stock market sentiment and reality.

►Speak convincingly in public. I debated in high school and the experience has been enormously helpful over the years.

►Give back. My partner-wife and I try to be meaningfully involved in a small list of non-profit organizations. All royalties from Watch That Rat Hole will go to BCS-YES Angel Scholarship Fund to aid at-risk youth in the Philadelphia area.

►Love what you do. If you don’t, change jobs.

►Dare to take reasonable risks that others shun. Timidity seldom wins the prize. Not every prospecting trip will pan out, but you must learn to be comfortable moving outside the mainstream and your own caution.

Phil Hall is managing editor of National Mortgage Professional Magazine. He may be reached by e-mail at [email protected].