Existing-Home Sales Decline in July

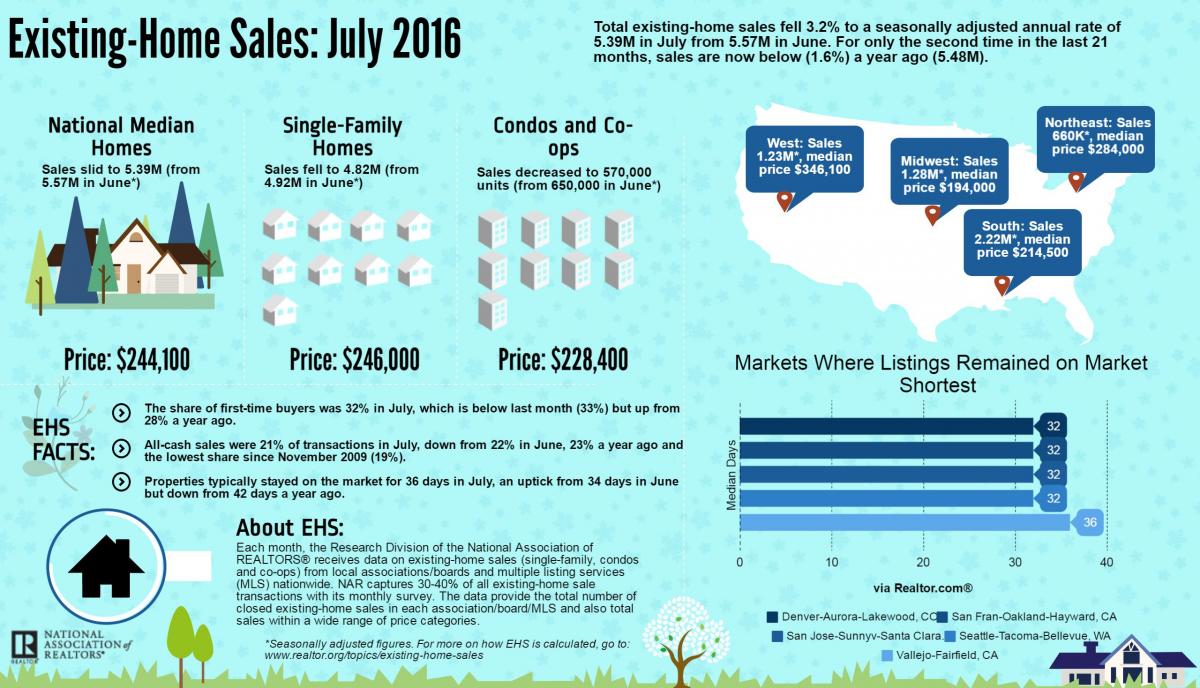

Total existing-home sales in July were down by 3.2 percent to a seasonally adjusted annual rate of 5.39 million, compared to 5.57 million in June, according to new data from the National Association of Realtors (NAR). July’s numbers represented a 1.6 percent decline from a year earlier, marking the second time in the last 21 months that year-over-year sales were in decline.

While existing-home sales were down, the median price for this type of property was up 5.3 percent from a year earlier, reaching $244,100. This was the 53rd consecutive month of year-over-year gains in this sector. And the total housing inventory was also up: 0.9 percent higher to 2.13 million existing homes available for sale in July, albeit 5.8 percent lower than a year ago. July was the 14th consecutive month of year-over-year inventory declines. The share of first-time buyers was 32 percent in July, one percent below June’s level but up four percent from a year ago.

“Severely restrained inventory and the tightening grip it’s putting on affordability is the primary culprit for the considerable sales slump throughout much of the country last month,” said NAR Chief Economist Lawrence Yun, adding that his organization’s members were “reporting diminished buyer traffic because of the scarce number of affordable homes on the market, and the lack of supply is stifling the efforts of many prospective buyers attempting to purchase while mortgage rates hover at historical lows.”

The existing-home sales numbers stood in stark contrast to yesterday’s report from the Census Bureau and the Department of Housing & Urban Development that sales of new single-family houses in July were at a seasonally adjusted annual rate of 654,000, which is 12.4 percent above the revised June rate of 582,000, 31.3 percent above the July 2015 estimate of 498,000, and nearly a nine-year high for new home sales activity.