Mortgage Apps Dip, While Home Prices Uptick

Fewer people were filling out mortgage applications last week, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey.

For the week ending Aug. 19, the Market Composite Index decreased 2.1 percent on a seasonally adjusted basis and decreased three percent on an unadjusted basis for the week compared to one week earlier. The seasonally adjusted Purchase Index dipped by 0.3 percent and the unadjusted Purchase Index dropped by two percent compared with the previous week, although the latter was eight percent higher than the same week one year ago. The Refinance Index took a three percent fall percent from the previous week as the refinance share of mortgage activity fell slightly to 62.4 percent of total applications from 62.6 percent the previous week.

As for the federal home loan programs, the FHA share of total applications decreased to 8.9 percent from 9.6 percent the week prior while the VA share of total applications decreased to 12.4 percent from 13.2 percent. The USDA share of total applications remained unchanged from 0.6 percent the week prior.

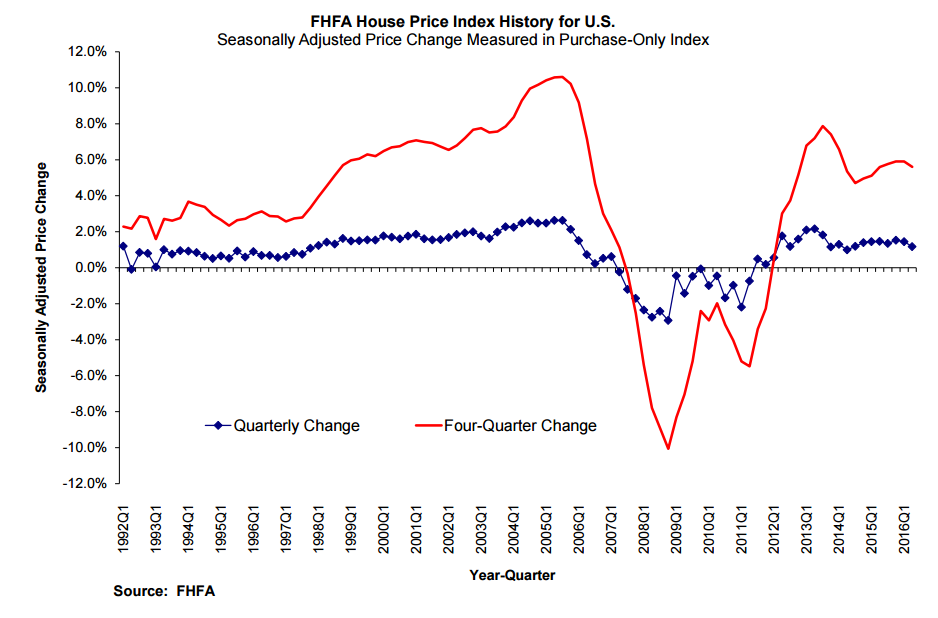

Separately, the Federal Housing Finance Agency (FHFA) announced in its latest House Price Index repot that U.S. house prices rose 1.2 percent in the second quarter, a 5.6 percent increase from one year ago. Every state except Vermont experienced a year-over-year home price appreciation, with Oregon leading the nation at an 11.7 percent rise. Among metro areas, the annual price increases was greatest in Florida’s North Port-Sarasota-Bradenton market (up 15.7 percent) and weakest in Connecticut’s Bridgeport-Stamford-Norwalk corridor (down 3.3 percent).

“Although the appreciation rate for the second quarter was of similar magnitude to what we’ve been seeing for several years now, a close look at the month-over-month price changes during the quarter reveals a potentially significant market shift,” said FHFA Supervisory Economist Andrew Leventis. “Our monthly price index indicates that in each of the three months of the quarter, the increase was only 0.2 percent. This is a much more modest pace of appreciation than we’ve seen in some time and most likely reflects accumulated pressures from significantly reduced home affordability.”