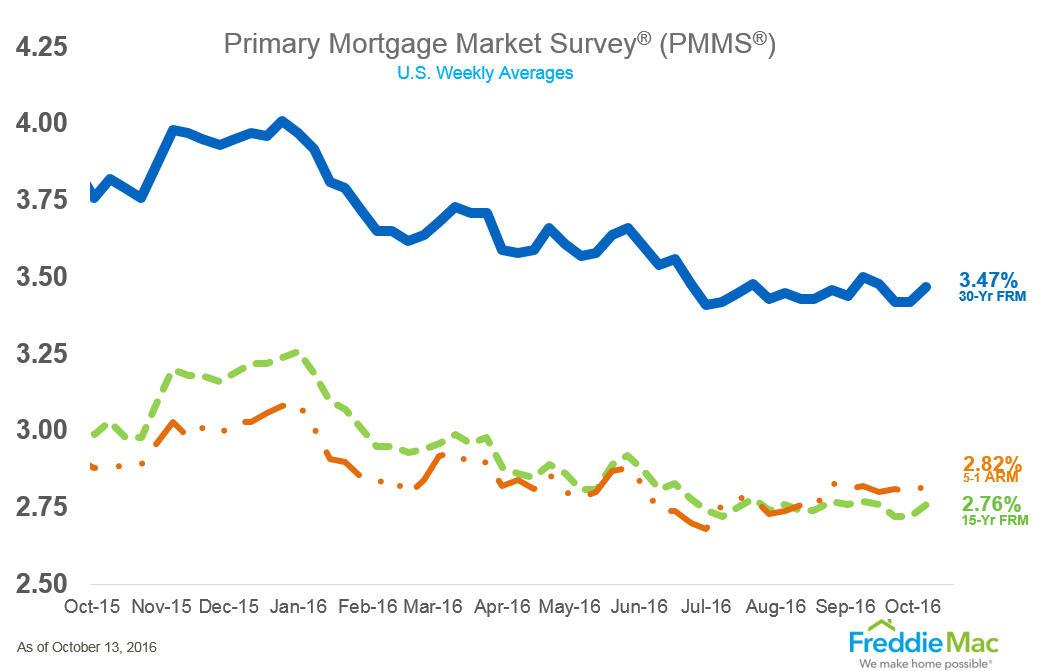

Mortgage Rates Inch Upward

Freddie Mac’s Primary Mortgage Market Survey (PMMS) reported a vertical upswing for average fixed mortgage rates. The 30-year fixed-rate mortgage (FRM) averaged 3.47 percent for the week ending Oct. 13, up from last week’s 3.42 percent. The 15-year FRM this week averaged 2.76 percent, up from last week when they averaged 2.72 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.82 percent this week, an increase from last week when it averaged 2.80 percent. A year ago, the 5-year ARM averaged 2.88 percent.

“This week, the 10-year Treasury yield continued its climb as an increasing number of financial market participants foresee a December rate hike after a series of positive economic data releases,” said Sean Becketti, chief economist at Freddie Mac. “The 30-year fixed-rate mortgage moved up five basis points to 3.47 percent in this week's survey, the first increase in one month. Even though we've seen economic activity pick up, consumer price inflation and implied inflation expectations remain below the Federal Reserve's two percent target."

Separately, the latest Mortgage Bankers Association Builder (MBA) Application Survey data found that mortgage applications for new home purchases increased by three percent from August to September. On a year-over-year basis, September’s activity level was seven percent higher. The MBA estimated new single-family home sales at a seasonally adjusted annual rate of 593,000 units in September, down 1.3 percent from the 601,000 level set in August. On an unadjusted basis, the MBA estimated 44,000 new home sales in September.

"After a strong start in 2016 and despite evidence of increasing costs, mortgage applications for new homes have maintained a pace modestly above 2015 rates," said MBA Vice President of Research and Economics Lynn Fisher. "The monthly decline in mortgage applications in September is largely attributable to typical declines in building activity this time of year. That said, builders are facing headwinds from rising labor costs. Looking forward, year over year growth in applications is likely to remain muted for the balance of 2016."