NMLS Launches "Your License Is Your Business" Campaign

The Conference of State Bank Supervisors (CSBS) has announced that the State Regulatory Registry LLC (SRR), operator of the Nationwide Multistate Licensing System (NMLS), has launched its third annual “Your License is Your Business” campaign, a nationwide effort to remind businesses and individuals working in non-depository financial services that “Your License is Your Business” and to encourage early renewal of licenses within the System.

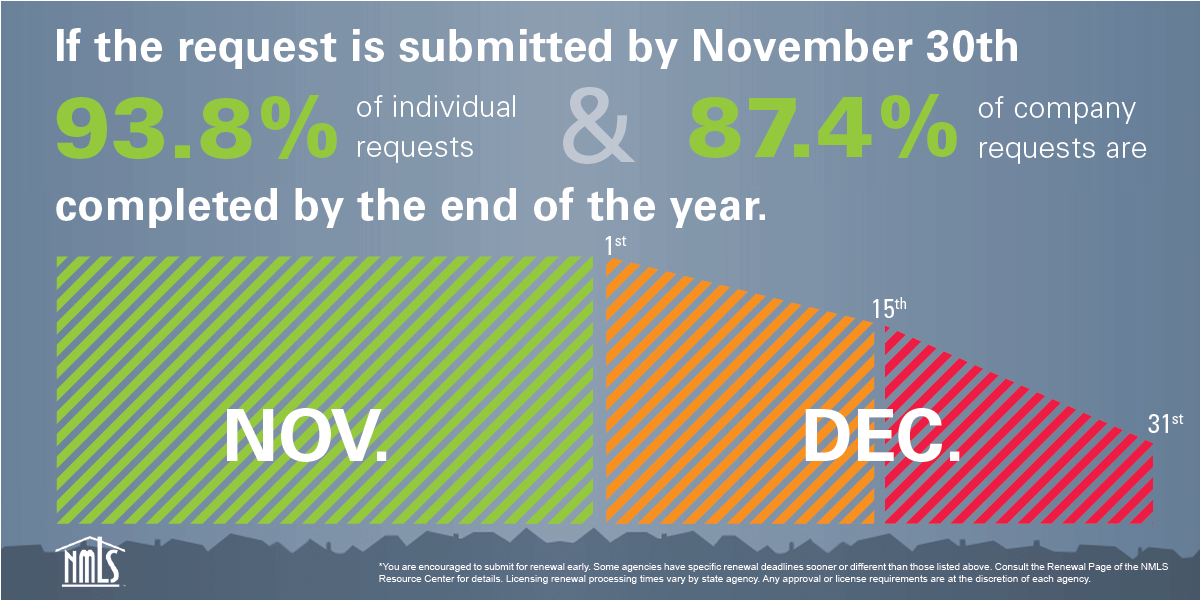

Building on the success of previous “Your License is Your Business” renewal campaigns, CSBS seeks to educate businesses and individuals, which hold more than 510,000 licenses that are managed in NMLS, that submitting renewal requests in November as opposed to December significantly reduces the chance of a license being terminated on Jan. 1, 2017.

“Nearly all renewal requests submitted in November are approved by year-end, resulting in no disruption in the ability to conduct business,” said Sue Clark, Director of Regulatory & Consumer Affairs for the Vermont Department of Financial Regulation and Chair of the NMLS Policy Committee. “In 2015, nearly 94 percent of all renewal applications submitted by November 30th were approved by December 31.”

In comparison, only about 53 percent of license renewals requested after Dec. 15 were approved by year-end.

NMLS makes renewing a license easy, and yet too many licensees lose their ability to operate in January because they wait until the last minute to complete professional requirements, such as continuing education courses or background checks, and submit their renewal request late in December.

Submitting a license renewal request takes only a few minutes and can save hours of work later if the license expires. To renew a license through NMLS, all one needs to do is log into the System, review the license record, select the state agency or agencies and license type, pay the associated fees, and submit the renewal request. Because licensees are expected to keep their license information up-to-date throughout the year, there is only a small amount of preparatory work to do at renewal for most licensees.

Visit the NMLS Twitter account @NMLSInfo for updates on where state-licensed individuals may go to learn more information and get important updates on renewal-related news, including key dates, education opportunities, information sources, and much more.

More information about renewing through NMLS can be found on the Annual Renewal Information page of the NMLS Resource Center.