Refis Rise in Q3

ATTOM Data Solutions has released its 2016 U.S. Residential Property Loan Origination Report for the third quarter, which shows more than 1.9 million (1,919,180) loans were originated on U.S. residential properties (one to four units) in the third quarter of 2016, down two percent from the previous quarter and up less than one percent from a year ago. The report also shows total dollar volume of loan originations increased eight percent from a year ago to more than $502 billion thanks to higher average loan amounts.

“The nominal increase in overall originations compared to a year ago masks divergent refinance and purchase loan origination trends during the quarter,” said Daren Blomquist, SVP at ATTOM Data Solutions. “Refinance originations increased 16 percent compared to a year ago while purchase originations were down 11 percent and Home Equity Lines of Credit (HELOC) originations were down 6 percent. Uncertainty surrounding the outcome of the presidential election may have kept some would-be homebuyers on the sidelines while the prospect of rising interest rates following the election may have prompted many homeowners to refinance to lock in low interest rates.”

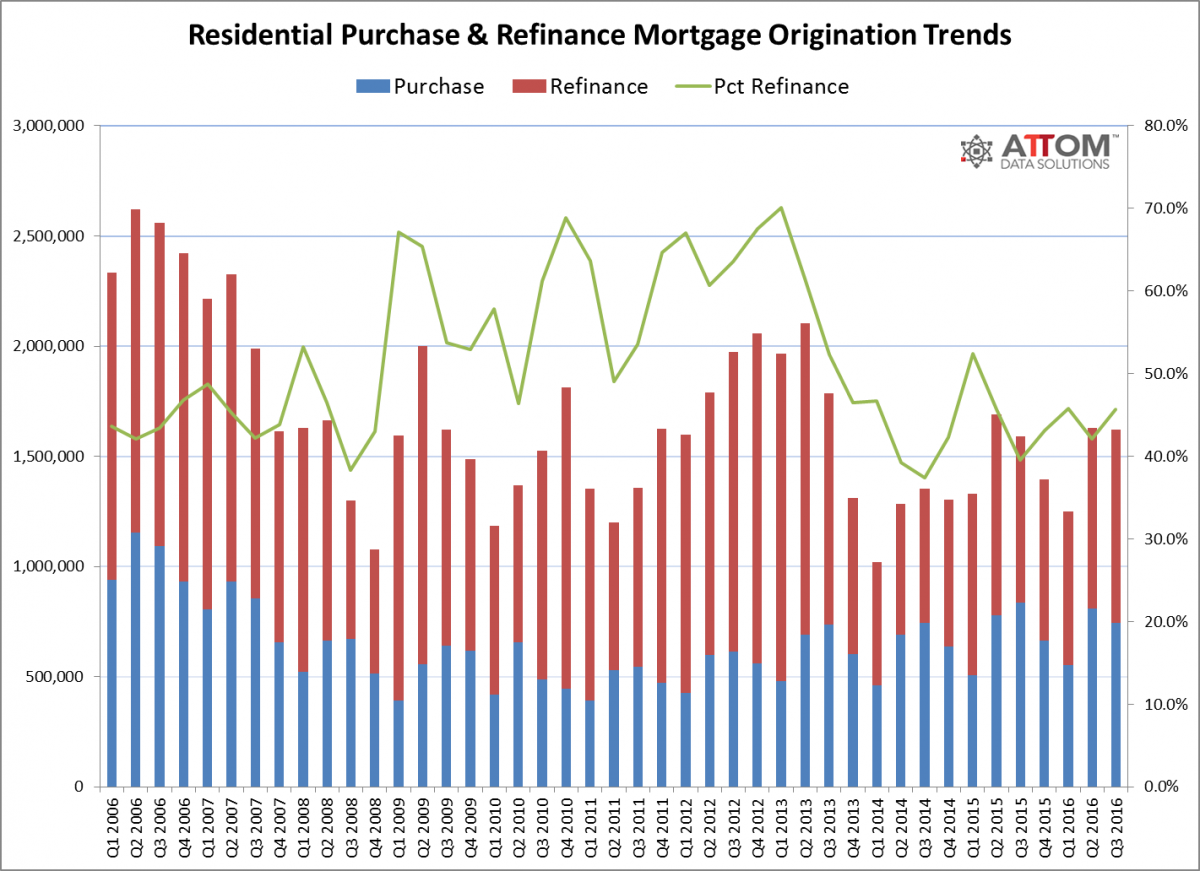

A total of 876,633 refinance loans secured by U.S. residential properties were originated in Q3 2016, up seven percent from the previous quarter and up 16 percent from a year ago. The year-over-year increase in refinance originations in Q3 2016, followed two consecutive quarters of year-over-year decreases. Refinance originations accounted for 45.7 percent of all loan originations in the third quarter, up from 42.1 percent in the previous quarter and up from 39.5 percent a year ago.

Among 101 metropolitan statistical areas with at least 1,000 loan originations in Q3 2016, those with the biggest year-over-year increase in refinance originations were Oxnard-Thousand Oaks-Ventura, Calif. (up 74 percent); San Diego, Calif. (up 73 percent); San Jose, Calif. (up 65 percent); Honolulu, Hawaii (up 64 percent); and Provo-Orem, Utah (up 63 percent).

Other metro areas with a year-over-year increase in refinance originations of at least 50 percent included Seattle, Wash. (up 56 percent); Portland, Ore. (up 54 percent); Boulder, Colo. (up 53 percent); Madison, Wis. (up 52 percent); and Phoenix, Ariz. (up 51 percent).

“Even before the election we were seeing an increase in refinance activity in the Seattle area in anticipation of rising mortgage rates,” said Matthew Gardner, chief economist at Windermere Real Estate, covering the Seattle market. “The rapid rise in rates following the election only made this increase in refinance activity more dramatic. But mortgage rates aren’t the only thing driving these refinances. Rising home prices in Seattle have allowed some of those who were paying Private Mortgage Insurance to refinance to a loan without it. It also allowed for cash-out refinancing for those who prefer to improve their homes rather than move. This is a popular option in Seattle where the number of homes for sale is at historic lows.”

A total of 743,880 purchase loans secured by U.S. residential properties were originated in Q3 2016, down eight percent from the previous quarter and down 11 percent from a year ago. Prior to Q3 2016, purchase originations had increased on a year-over-year basis for nine consecutive quarters going back to Q2 2014. Purchase originations accounted for 38.8 percent of all loan originations in the third quarter, down from 41.4 percent in the previous quarter and down from 43.8 percent a year ago.

Among 101 metropolitan statistical areas with at least 1,000 loan originations in Q3 2016, those with the biggest year-over-year decrease in purchase originations were Raleigh, N.C. (down 37 percent); Houston, Texas (down 29 percent); Naples, Fla. (down 26 percent); Philadelphia, Penn. (down 24 percent); and Killeen, Texas (down 23 percent).

Counter to the national trend, 39 of the 101 metro areas analyzed in the report posted year-over-year increases in purchase loan originations, led by Boise, Idaho (up 16 percent); Lancaster, Penn. (up 15 percent); Flint, Mich. (up 14 percent); Olympia, Wash.n (up 13 percent); and Cleveland, Ohio (up 12 percent).

A total of 298,667 HELOCs were originated in Q3 2016, down seven percent from the previous quarter and down six percent from a year ago. Prior to Q3 2016, HELOC originations had increased on a year-over-year basis for 17 consecutive quarters going back to Q2 2012. HELOC originations accounted for 15.6 percent of all loan originations in the third quarter, down from 16.5 percent in the previous quarter and down from 16.7 percent a year ago.

Among 101 metropolitan statistical areas with at least 1,000 loan originations in Q3 2016, those with the biggest year-over-year decrease in HELOC originations were Philadelphia, Penn. (down 22 percent); Houston, Texas (down 22 percent); Bakersfield, Calif. (down 20 percent); San Francisco, Calif. (down 17 percent); and Killeen, Texas (down 16 percent).

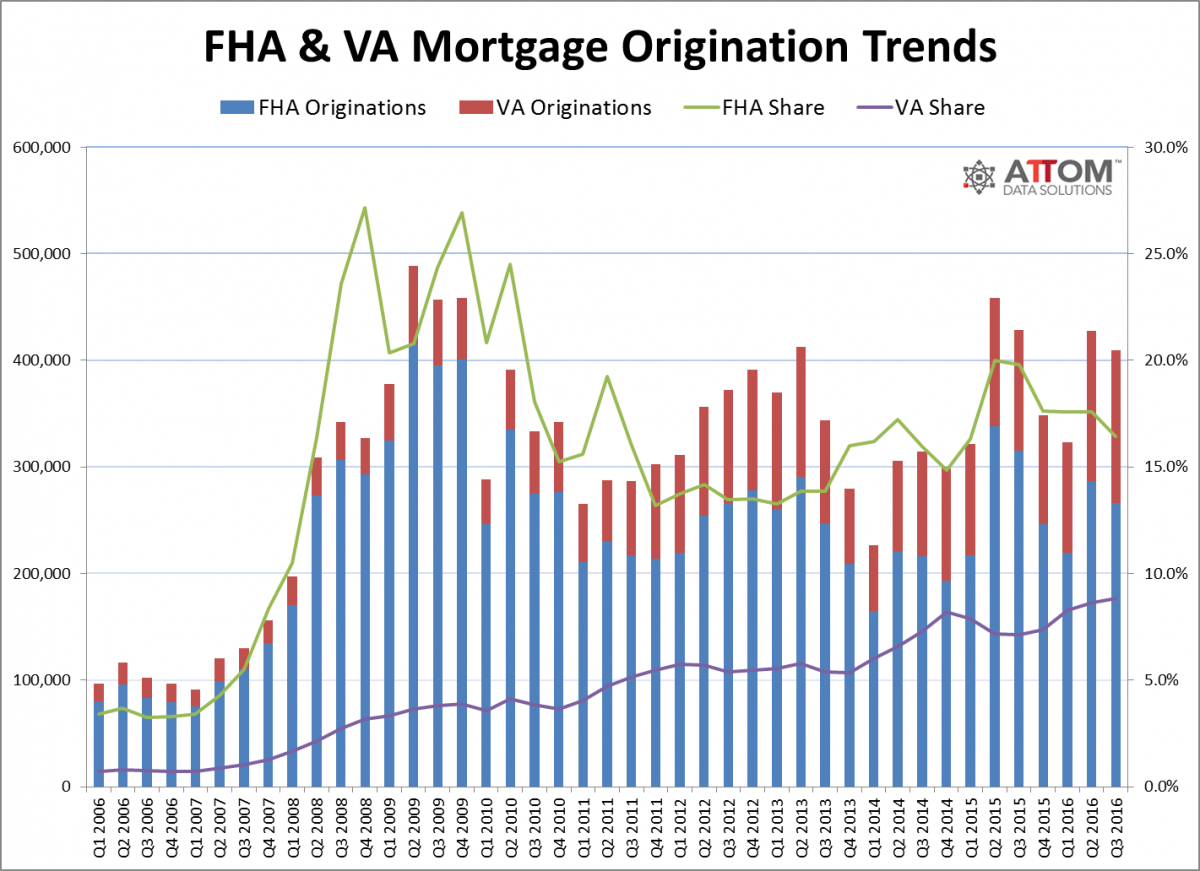

A total of 143,366 loans backed by the U.S. Department of Veterans Affairs (VA) loans were originated in Q3 2016, up two percent from the previous quarter and up 26 percent to a year ago to the highest level as far back as data was tracked in the report (Q1 2006). The third quarter marked the second consecutive quarter where VA loan originations increased on a year-over-year basis. VA loans originated in Q3 2016 accounted for 8.8 percent of all loans originated during the quarter, up from 8.6 percent the previous quarter and up from 7.1 percent a year ago to the highest share of VA loans since Q1 2006.

A total of 266,404 loans backed by the Federal Housing Administration (FHA) were originated in Q3 2016, down seven percent from the previous quarter and down 15 percent from a year ago. The third quarter marked the second consecutive quarter where FHA loan originations decreased on a year-over-year basis.

FHA-backed loans originated in Q3 2016 accounted for 16.4 percent of all loans originated during the quarter, down from 17.6 percent the previous quarter and down from 19.8 percent a year ago to the lowest share since Q1 2015.