HOPE NOW: 113K Mortgage Solutions in October

There is more very good news on the mortgage servicing side of the industry: According to the latest data from HOPE NOW, there were 113,000 mortgage solutions completed in October, compared to just more than 19,000 completed foreclosures, a nearly six-to-one difference.

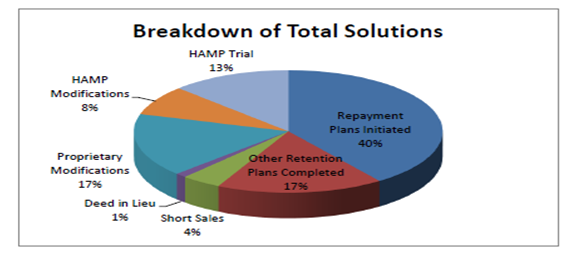

Included in that total solutions figure were an estimated 28,000 permanent loan modifications—19,000 through proprietary programs and 8,900 through the federal HAMP endeavor—plus 4,800 short sales and 1,300 deeds in-lieu. Serious delinquencies totaled approximately 1.47 million in October, down from 1.49 million in September.

“We are pleased to see that these total solutions are still significantly outpacing foreclosure sales on a consistent basis,” said HOPE NOW Executive Director Erik Selk. “We are close to pre-crisis levels and that is good news. Foreclosure starts and sales are at all-time lows, while solutions provided continue to hold steady. By reviewing the data from a year ago, we are also happy to see double digit decreases in foreclosure numbers and delinquency volume.”