New Data Finds Negative Equity More Severe in Black Neighborhoods

Homeowners in predominantly African-American communities are twice as likely to be underwater on their mortgages as homeowners in mostly White communities, according to a new report by Zillow.

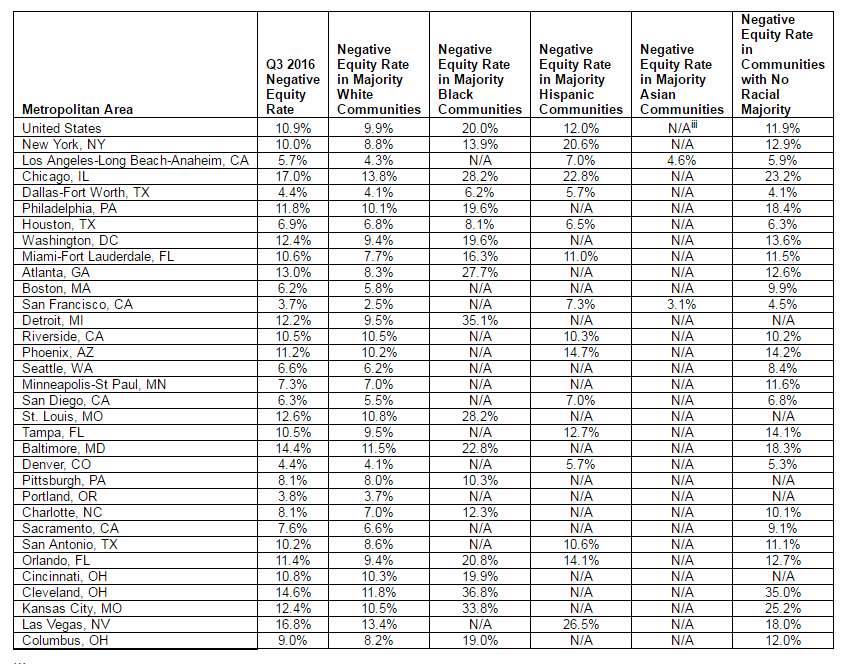

Although the national negative equity rate was 10.9 percent in the third quarter of 2016, Zillow noted U.S. Census Bureau data that found predominantly black neighborhoods had a negative equity rate of 20 percent while predominantly White neighborhoods had a 9.9 percent rate and predominantly Hispanic neighborhoods had a 12 percent rate.

In some metro markets, the racial disparity was severe: Detroit, for example, saw a 35.1 percent negative equity rate in predominantly Black neighborhoods and a 9.5 percent rate in predominantly White neighborhoods.

"Negative equity is not an equal opportunity offender, with certain markets still being more affected than others," said Zillow Chief Economist Svenja Gudell. "Our previous research has shown that negative equity is more concentrated among less expensive homes, and now we know that it is also more prevalent in minority neighborhoods than in White communities, which are also trailing in the overall housing recovery. These gaps can and will have long lasting implications for growth and equality."