Advertisement

Mortgage Applications Take a Tumble

The last full week of winter was chilly one for the home loan market, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending March 17.

The Market Composite Index dropped by 2.7 percent on a seasonally adjusted basis and fell by two percent on an unadjusted basis. Both the seasonally adjusted and the unadjusted Purchase Index decreased by two percent from one week earlier, although the latter was five percent and the Government Refinance Index sank by 12 percent to the lowest level since December 2014 while the refinance share of mortgage activity dipped to 45.1 percent of total applications from 45.6 percent the previous week.

Among the federal mortgage programs, the FHA share of total applications decreased to 10.9 percent from 11.1 percent the week prior while the VA share of total applications fell to 10.1 percent from 11.1 percent the week prior. The USDA share of total applications, once again, remained unchanged at 0.9 percent.

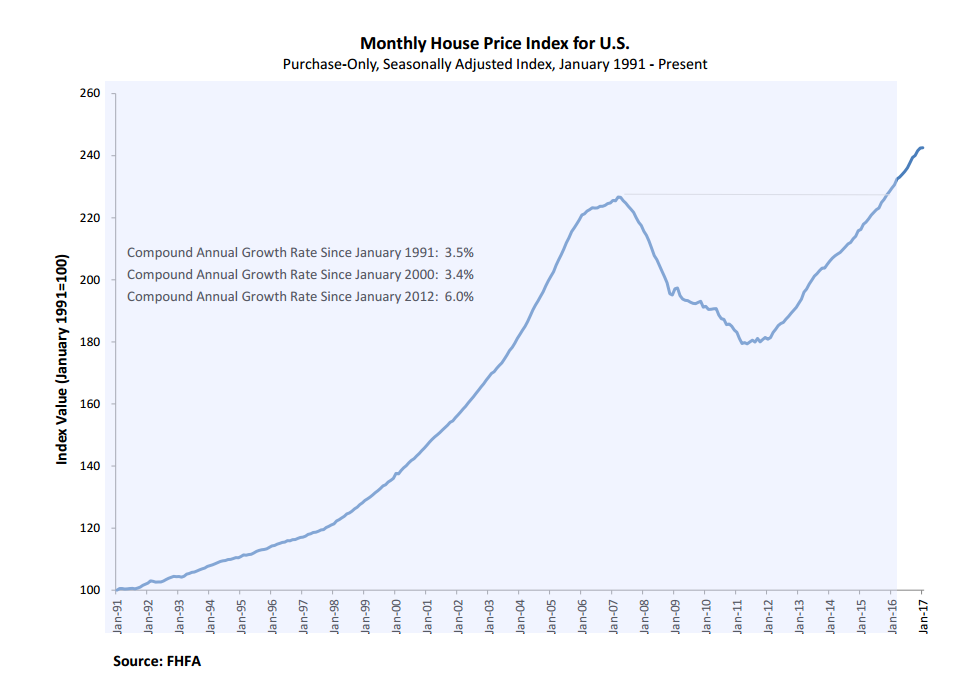

Separately, the Federal Housing Finance Agency (FHFA) announced house prices remained flat in January. This is the only the second time since early 2012 that there was no positive monthly increase; the previously reported 0.4 percent increase in December remains unrevised. On a year-over-year basis, however, house prices were up 5.7 percent in January. All nine census divisions also registered positive year-over-year growth while three divisions saw declines from December to January, most notably a two percent drop in the East South Central division.

About the author