Advertisement

Ocwen Assists 30,000-Plus Struggling Families in Q1 and Q2

Ocwen Financial Corporation has announced loan modification borrower assistance results for the first half of 2017, as the company helped approximately 30,000 families avoid foreclosure and remain in their homes in the first six months of 2017.

Ocwen Financial Corporation has announced loan modification borrower assistance results for the first half of 2017, as the company helped approximately 30,000 families avoid foreclosure and remain in their homes in the first six months of 2017.Since the sunset of the U.S. Department of the Treasury’s Home Affordable Mortgage Program (HAMP) at the end of 2016, Ocwen has continued to optimize its own loan modification products to assist struggling borrowers. The company’s products include a principal forgiveness component to qualified borrowers and allows for a mortgage payment reduction of up to 20 percent to achieve an affordable mortgage payment and a sustainable performing loan.

During the first half of 2017, Ocwen forgave approximately $595 million in mortgage debt as part of its industry-leading borrower assistance programs. Similar to the HAMP program, all modifications are designed to be sustainable for homeowners, while providing an estimated net present value for mortgage loan investors that is superior to that of foreclosure.

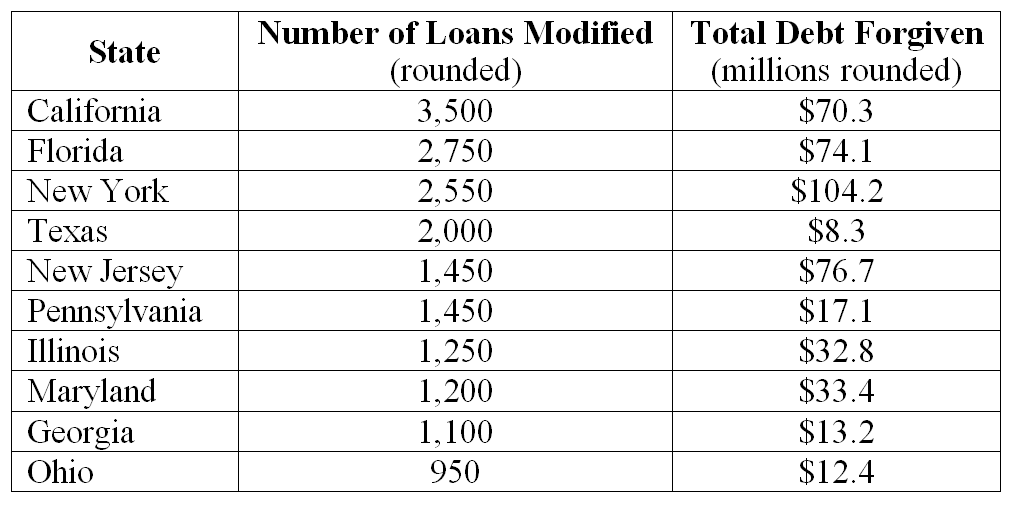

Below are the top 10 states where Ocwen modified loans and forgave debt in the first half of 2017:

Additionally, Ocwen customers were the beneficiaries of more than $19.2 million of housing assistance distributed through state-administered Hardest Hit Fund programs in the first half of 2017. Ocwen is working directly with state housing finance agencies and local non-profit agencies on creative ways to reach qualified borrowers, including targeted outreach campaigns to customers in California, Florida, Illinois, Michigan, Nevada, and North Carolina.

Additionally, Ocwen customers were the beneficiaries of more than $19.2 million of housing assistance distributed through state-administered Hardest Hit Fund programs in the first half of 2017. Ocwen is working directly with state housing finance agencies and local non-profit agencies on creative ways to reach qualified borrowers, including targeted outreach campaigns to customers in California, Florida, Illinois, Michigan, Nevada, and North Carolina.

“Ocwen’s consistent philosophy has been that all parties benefit when solutions are offered that allow borrowers to cure their delinquencies and remain in their homes and in their communities,” said Ron Faris, President and Chief Executive Officer of Ocwen. “Ocwen continues to lead the industry in providing responsible and sustainable loan modifications to struggling homeowners, and we are proud of the difference we make in our customers’ lives.”

About the author