Advertisement

Cordray Evades Question on His Political Future

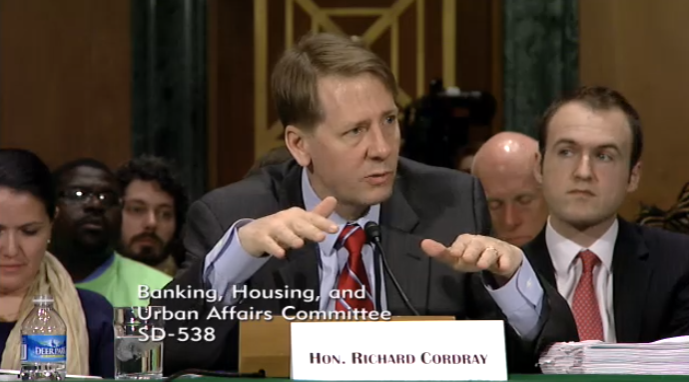

The speculation on whether Richard Cordray will remain as the director of the Consumer Financial Protection Bureau (CFPB) or quit to run for governor of Ohio was intensified by Cordray’s refusal to offer a direct answer on the subject.

According to a Reuters report, Rep. Jeb Hensarling (R-TX), the chairman of the House Financial Services Committee, sent Cordray a letter earlier this week demanding to know whether he would fulfill his CFPB term, which expires in July 2018, or whether he would leave Washington and return to state politics in Ohio, which has been the subject of media and political speculation. Cordray responded with a vague and evasive letter to Hensarling that said, “You ask whether I intend to serve my full statutory term. At this time, I have no further insights to provide on that subject.”

Hensarling publicly responded with displeasure at Cordray’s response. “I am disappointed by Director Cordray’s steadfast refusal to be transparent with the public about his intentions,” he said. “If he intends to serve his full term, there is no reason not to say so. The only reasonable conclusion is that he therefore harbors partisan political ambitions, which calls into question the propriety of all of his recent and future actions as CFPB Director.”

About the author