Advertisement

30-Year Fixed Rate Mortgage Tumbles Even Lower

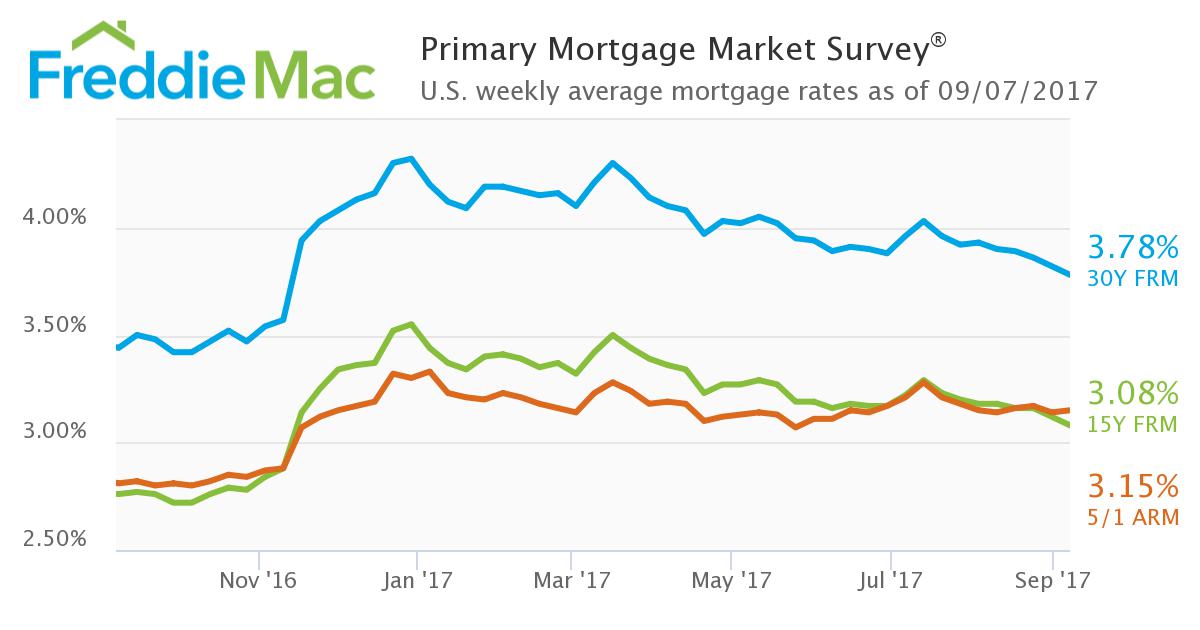

Do you remember the other week when we reported that the 30-year fixed rate mortgage (FRM) had reached a 2017 low? Well, we need to update ourselves: it reached a new 2017 low.

According to Freddie Mac, the 30-year fixed-rate mortgage (FRM) averaged 3.78 percent for the week ending Sept. 7, 2017, down from last week when it averaged 3.82 percent. The 15-year FRM this week averaged 3.08 percent, down from last week when it averaged 3.12 percent. However, the 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.15 percent this week up from last week when it averaged 3.14 percent.

Sean Becketti, chief economist at Freddie Mac, noted the 30-year mortgage was not the only thing on the decline.

Sean Becketti, chief economist at Freddie Mac, noted the 30-year mortgage was not the only thing on the decline.

"The 10-year Treasury yield fell nine basis points this week, reaching a new 2017 low for a second consecutive week,” he said.

About the author