Advertisement

First Mortgage Defaults Up Slightly

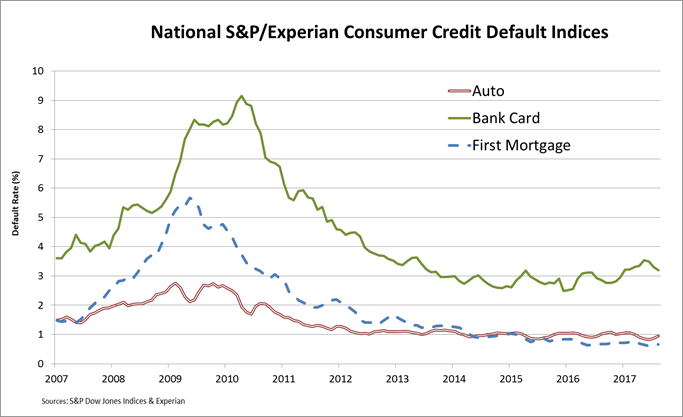

The default rate on first mortgages was up slightly in August, according to new data released by the S&P/Experian Consumer Credit Default Indices.

The first mortgage default rate increased from 0.62 percent in July to 0.65 in August; on a year-over-year measurement, last month’s rate was three basis points (bps) below the 0.68 percent rate in August 2016. The second mortgage default rate was unchanged from July to August at 0.50 percent, and was slightly lower than the 0.52 percent rate from August 2016.

The composite consumer default rate increased from 0.83 percent in July to last month’s 0.86 percent. The bank card default rate continued to fall, down 12 bps to 3.19 percent, but auto loan defaults increased by nine bps to 0.95 percent.

David M. Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, warned that damage from Hurricanes Harvey and Irma could create “substantial financial stress” on credit default rates.

David M. Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, warned that damage from Hurricanes Harvey and Irma could create “substantial financial stress” on credit default rates.

“The impact on mortgages on damaged or destroyed homes is not yet clear,” Blitzer said. “Job losses and rising spending needs could lead to increased consumer credit defaults in coming months.”

About the author