Advertisement

Home Affordability Remains a Serious Challenge

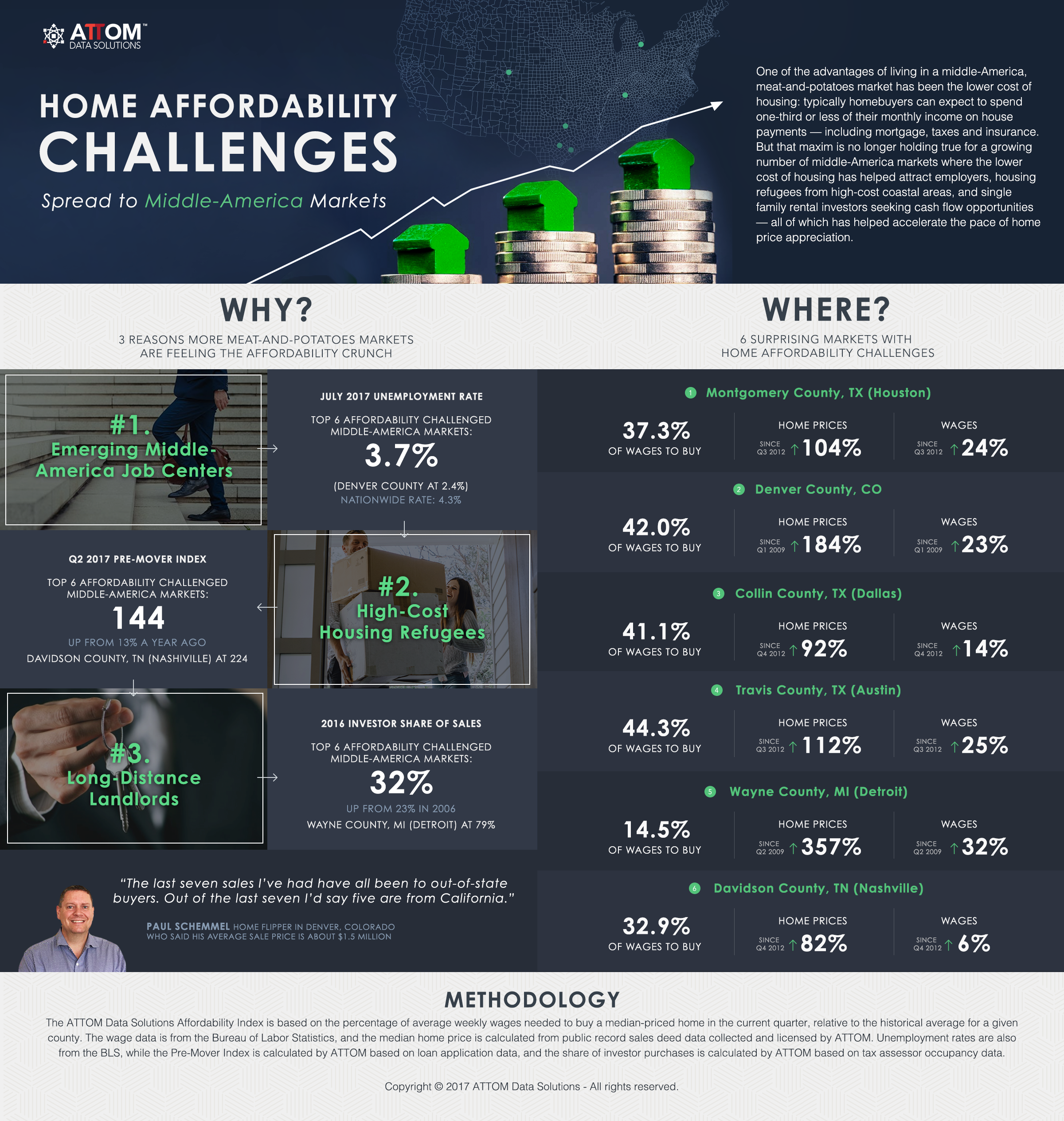

There is good news and bad news on the home affordability, according to new research from ATTOM Data Solutions. The good news is that home affordability in the third quarter improved compared to the previous quarter in 60 percent of 406 counties analyzed by the company. The bad news, unfortunately, is that affordability was worse off than a year ago in 79 percent of those counties.

During the third quarter, ATTOM found were more affordable in 243 of the 406 counties that it analyzed when compared to the second quarter, most notably in such pricey housing markets as California’s Los Angeles County and San Diego County. But in 163 counties, there was a quarter-over-quarter decline in affordability, most notably in Michigan’s Wayne County (home to the Detroit metro area) and Massachusetts’ Middlesex County (home to the Boston metro area).

Furthermore, home prices were less affordable than their historic affordability averages in 184 out of 406 of the counties analyzed for the index, or 45 percent, down from 49 percent in the previous quarter but still up from 21 percent a year ago. ATTOM’s national home affordability index was 100 in the third quarter, the lowest level in nine years.

“Falling interest rates in the third quarter provided enough of a cushion to counteract rising home prices in most U.S. markets and provide at least some temporary relief for the home affordability crunch,” said Daren Blomquist, Senior Vice President at ATTOM Data Solutions. “More sustainable relief for the affordability crunch, however, will need to be some combination of slowing home price appreciation and accelerating wage growth. Wage growth is outpacing home price growth in about half of all local markets so far this year, an indication that a more sustainable affordability pattern is taking shape in more local markets.”

About the author