Advertisement

HUD’s Dr. Carson Outlines New Policy Focus

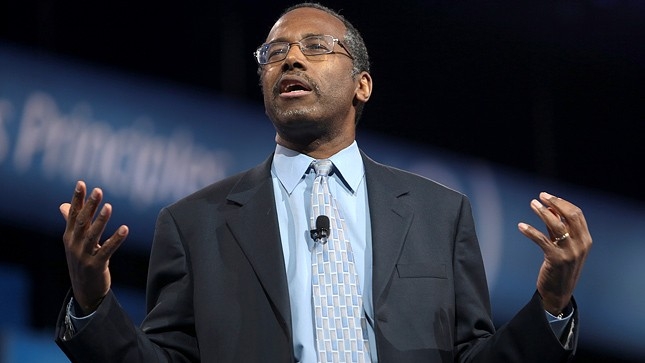

U.S. Department of Housing & Urban Development (HUD) Secretary Dr. Ben Carson unveiled the Trump Administration’s housing policy shift in an endeavor dubbed the FORWARD initiative.

Speaking today before the House Financial Services Committee, Dr. Carson explained the initiative could be defined by three R’s: Reimagine How HUD Works, Restore the American Dream, and Rethink American Communities.

“We must constantly evaluate our programs to ensure that we are delivering services effectively and efficiently to HUD’s constituents, and responding to today’s challenges with the best practices and technologies,” Dr. Carson said in a prepared statement delivered before the committee. “Since I arrived at HUD in March, it has been my mission to employ the wealth of institutional knowledge held by career staff to improve our services, reform our programs to reflect realities of modern society, and remain careful stewards of taxpayer dollars.”

While not offering specific details on how this initiative would achieve these goals—or, for that matter, explaining why “FORWARD” was being presented entirely in upper-case letters—Dr. Carson signaled several changes that HUD would undertake, including what he identified as “revisiting the Federal Housing Administration’s (FHA’s) condominium rules to consider opening up assistance to more first-time homebuyers” and an effort to “modernize FHA’s systems and programs to reduce risk and ensure that they will be available for future generations.” Dr. Carson also outlined an expansion of public-private partnerships and an increased engagement with nonprofits, including religious institutions, which he said “produces better results than heavy-handed government interventions.”

Citing his medical background, Dr. Carson also promised that he would make a “special priority to help more American families live in healthy homes free of lead hazards and other poisonous substances.” Furthermore, he cited the recent damage brought by back-to-back hurricanes in having HUD support FEMA in assisting households in impacted areas.

“In addition, we are providing FHA mortgage insurance to people who have lost their homes,” he added. “Some will be eligible for 100 percent financing through HUD’s Section 203(h) program. HUD has also granted a 90-day moratorium on foreclosures, and a 90-day forbearance on foreclosures of FHA-insured mortgages.”

About the author