Advertisement

Fewer First-Time Homebuyers in the Market

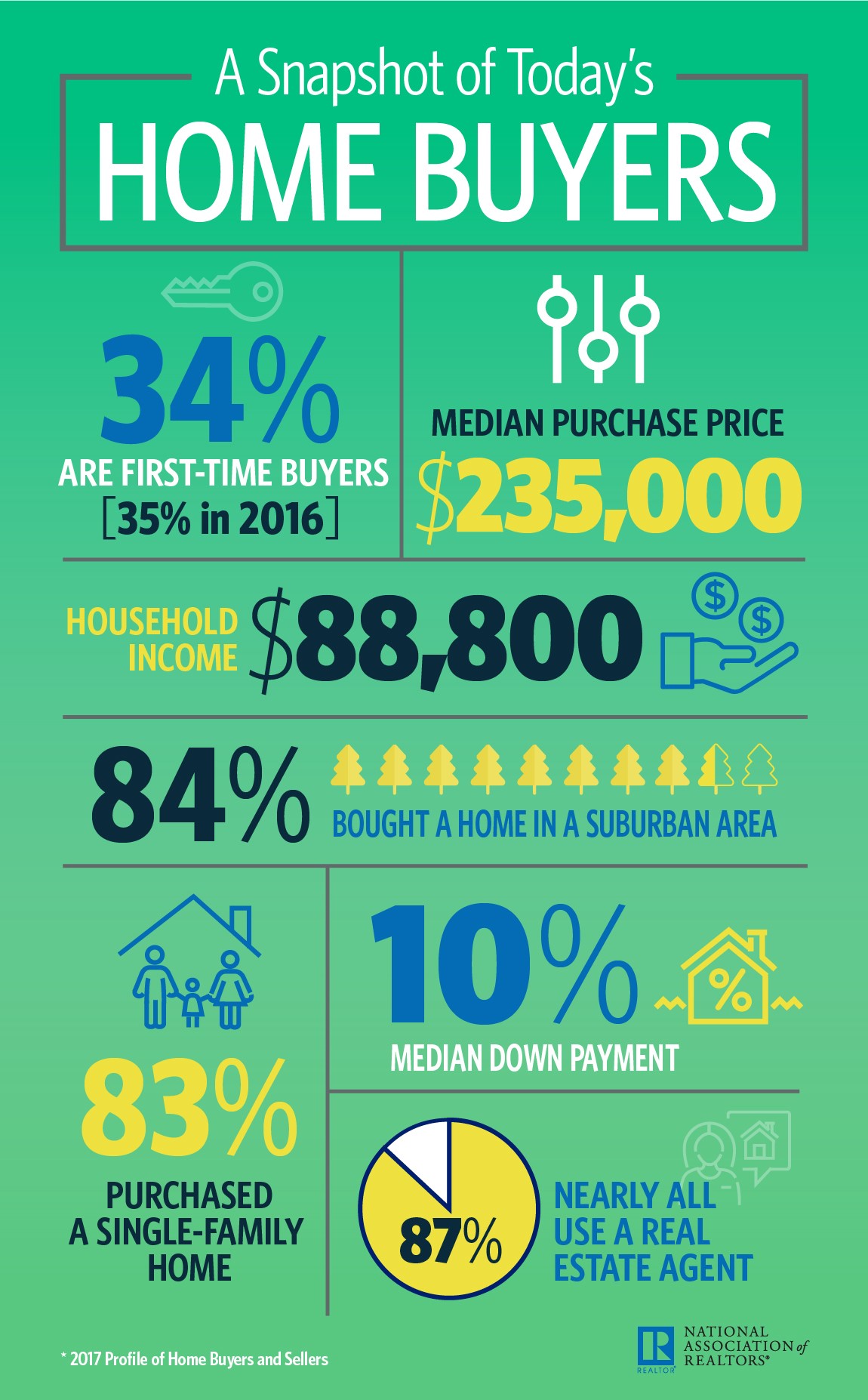

The share of sales to first-time homebuyers fell this year to 34 percent, the lowest level since 1981, according to data released by the National Association of Realtors (NAR). Last year’s level was 35 percent, and the decline was primarily attributed to a lack of housing supply.

“The dreams of many aspiring first-time buyers were unfortunately dimmed over the past year by persistent inventory shortages, which undercut their ability to become homeowners,” said Lawrence Yun, NAR Chief Economist. “With the lower end of the market seeing the worst of the supply crunch, house hunters faced mounting odds in finding their first home. Multiple offers were a common occurrence, investors paying in cash had the upper hand, and prices kept climbing, which yanked homeownership out of reach for countless would-be buyers.”

Also contributing to the challenges facing first-time homebuyers was student debt—41 percent acknowledged being burdened by this, up from 40 percent last year. The typical debt balance also increased, reaching the current level of $29,000 versus $26,000 in 2016, and more than half of the respondents to NAR’s query said they owed at least $25,000. Of the 25 percent who said saving for a downpayment was the most difficult task in the buying process, 55 percent said student debt delayed their attempts to save for a home.

Among the more dramatic aspects of first-time homebuyers is gender disparity: 18 percent of single women were buyers, compared to seven percent of men. Married couples were the most common homebuyers (65 percent), while unmarried couples accounted for only eight percent.

For the second straight year, the median age of first-time buyers was 32 years old, while these buyers had household income ($75,000) than a year ago ($72,000) and purchased a slightly smaller home (1,640 square feet) than one year earlier (1,650 square feet in 2016) that was more expensive ($190,000, up from $182,500 in 2016).

Forty-two percent of buyers paid the list price or higher for their home, which is up from 40 percent one year ago, and this marked and a new survey high since tracking began in 2007. Buyers in the West were the most likely (51 percent) to pay at or above list price.

“Many of those in the market to buy a home this year had little room to negotiate,” said Yun. “Listings in the affordable price range drew immediate interest, and the winning offer often times had to waive some contingencies or come in at or above asking price to close the deal.”

About the author