Advertisement

Distressed Home Sales at 10-Year Low

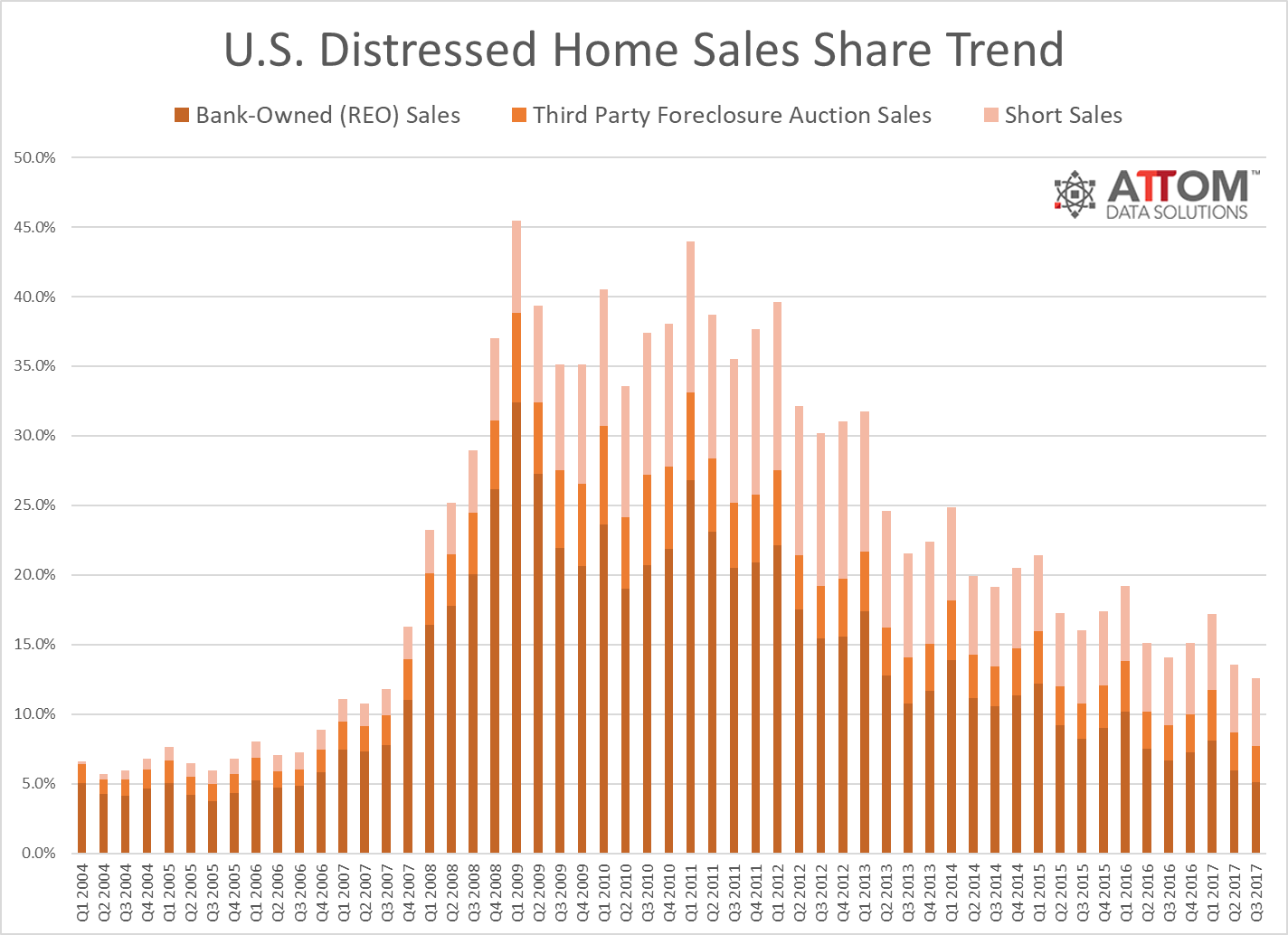

Distressed home sales accounted for 12.5 percent of all residential sales activity in the third quarter, according to new figures released by ATTOM Data Solutions. This is down from the down from 13.5 percent in the previous quarter and down from 14.1 percent one year earlier, and it is also the lowest level recorded since the third quarter of 2007.

However, 29 of the 146 metros analyzed by ATTOM, or 20 percent of the major housing markets, posted year-over-year increases in distressed sales. The greatest increases were recorded in Corpus Christi, Texas (up 33 percent), Indianapolis (up 30 percent); Cedar Rapids, Iowa (up 29 percent), Baton Rouge, La. (up 25 percent) and Oklahoma City and Provo, Utah (both up 22 percent). In comparison, the smallest shares of year-over-year distressed sales activity were San Jose (3.1 percent), Salt Lake City, Utah (3.3 percent), Austin (4.1 percent), San Francisco (5.2 percent) and Utah’s Provo-Orem metro area (5.5 percent).

“Distressed sales nationally are now the exception rather than the rule, and we would expect the distressed sale share to return to the pre-recession norm of single-digit percentages within the next year given the current downward trajectory,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “Distressed sales have become more localized in nature, with some of the biggest increases from a year ago in markets experiencing regional economic weakness or a natural disaster event that has triggered a jump in foreclosure activity.”

About the author