Advertisement

Home Flipping Set New Peaks in 2017

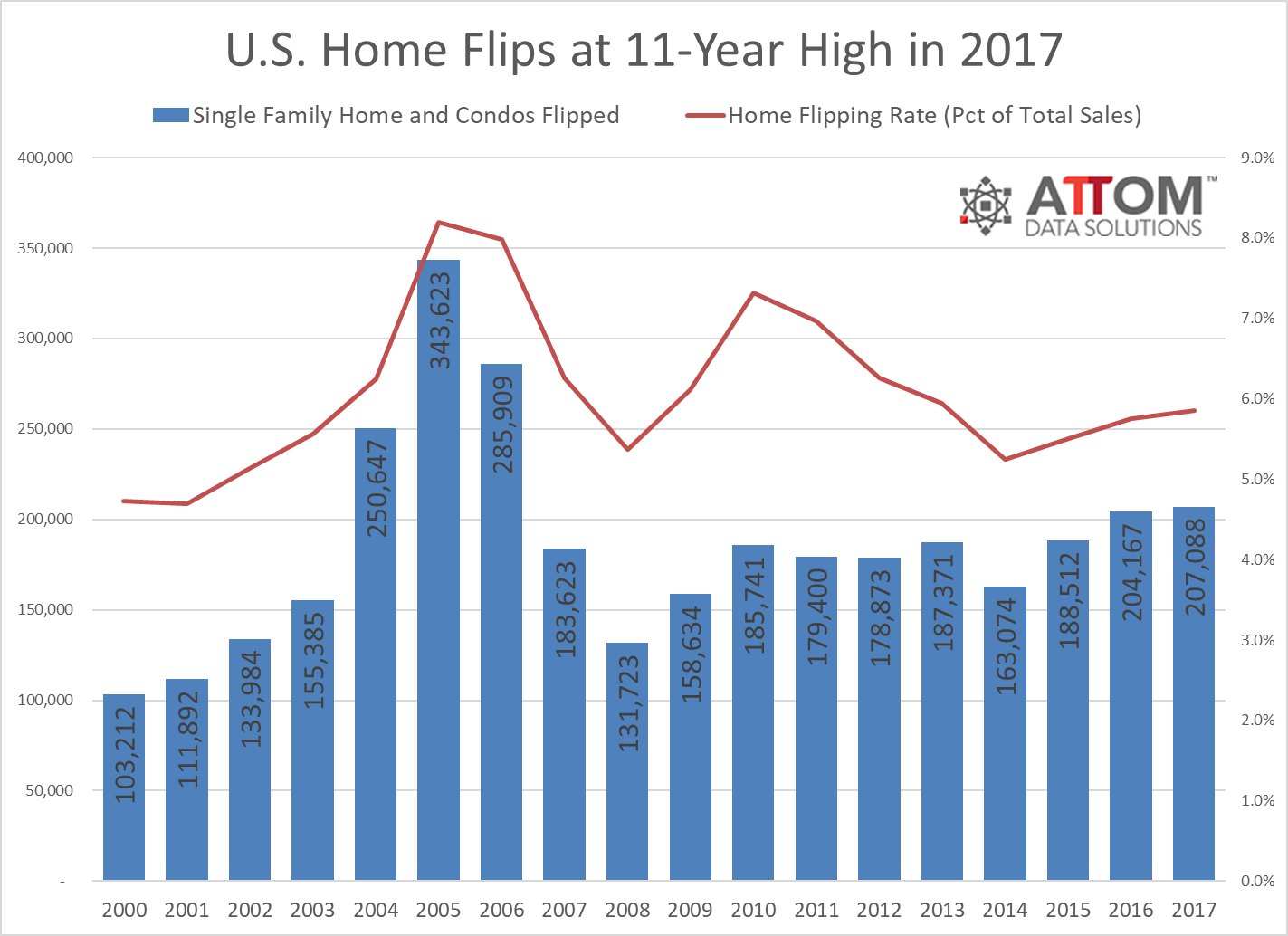

A total of 207,088 single-family homes and condos were flipped in 2017, up one percent from the 204,167 home flips in 2016 to the highest level since 2006, according to new research from ATTOM Data Solutions.

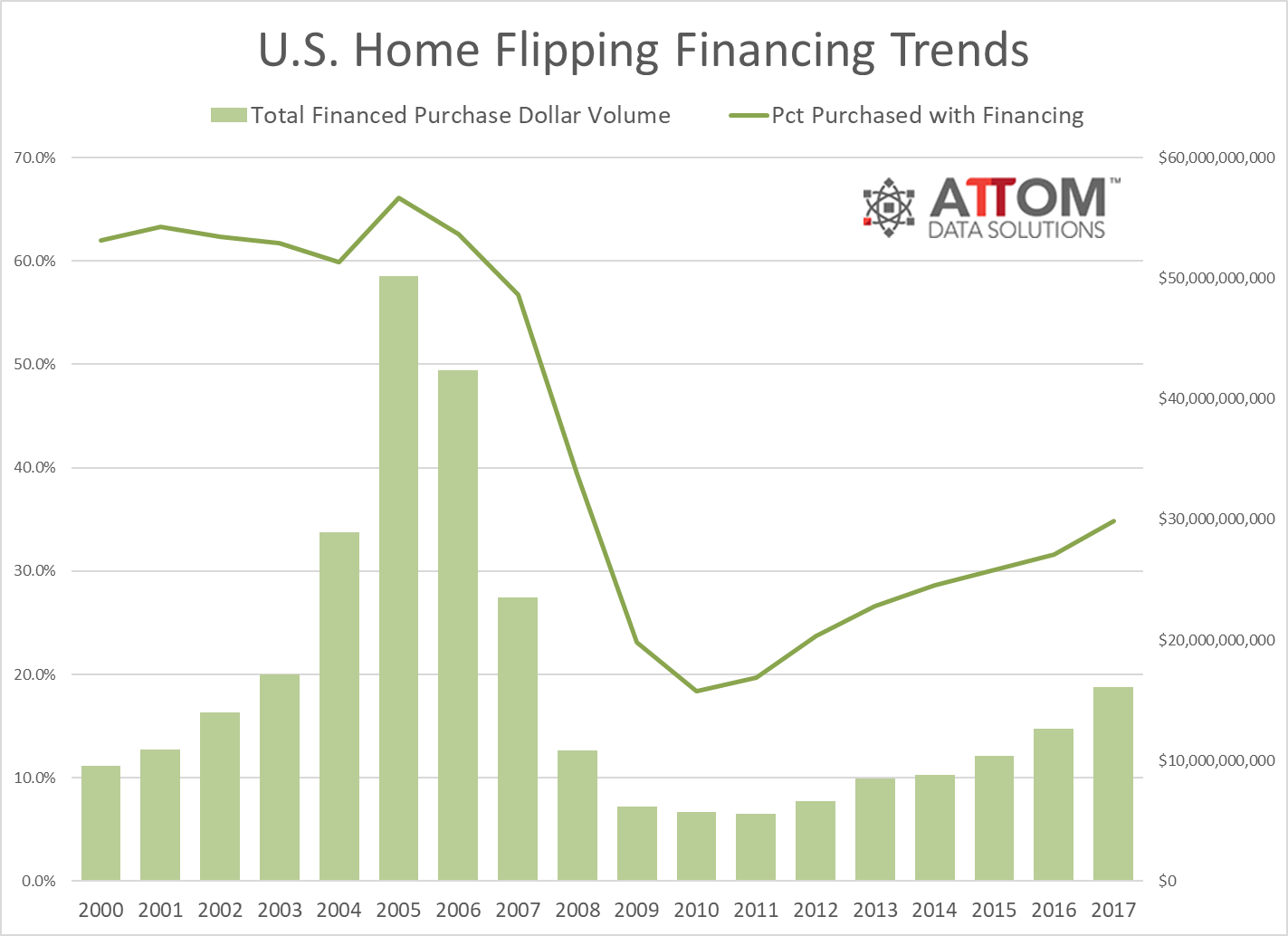

Last year’s level represented 5.9 percent of all single-family home and condo sales during the year, up from 5.7 percent of all sales in 2016 to the highest level since 2013. A total of 138,410 entities—both individuals and companies—were flipping homes last year, up 4 percent from the 133,407 entities that flipped in 2016, reaching the highest level since 2007. Another peak was set with the total dollar volume of financed home flip purchases: $16.1 billion for homes flipped in 2017, up 27 percent from $12.7 billion in 2016 to the highest level since 2007. And flipped homes originally purchased by the investor with financing represented 34.8 percent of homes flipped in 2017, up from 31.6 percent in 2016 to the highest level since 2008.

Furthermore, completed home flips in 2017 yielded an average gross profit of $68,143, up five percent from an average gross flipping profit of $64,900 in 2016 to a new all-time high in the 18 years this data has been tracked. The average gross flipping profit of $68,143 in 2017 represented an average 49.8 percent return on investment, down from last year’s all-time high of 51.9 percent in 2016 but still the second highest level recorded in 18 years.

Among the nation’s major metro areas, the highest percentage with completed flips purchased with financing in 2017 were Denver (55.4 percent); Boston (52.8 percent); Providence, R.I. (49.4 percent); San Diego (48.5 percent); and Seattle (48 percent).

“The surge in home flipping in the last three years is built on a more fundamentally sound foundation than the flipping frenzy that we witnessed a little more than a decade ago,” said Daren Blomquist, Senior Vice President at ATTOM Data Solutions. “Flippers are behaving more rationally, as evidenced by average gross flipping returns of 50 percent over the last three years compared to average gross flipping returns of just 31 percent between 2004 and 2006—the last time we saw more than 200,000 home flips in consecutive years. And while financing for flippers has become more readily available in recent years, 65 percent of flippers still used cash to buy homes flipped in 2017, nearly the reverse of 2004 to 2006, when 63 percent of flippers were leveraging financing to buy.”

About the author