Advertisement

Originations Down, Home Equity Up in Q4 2017

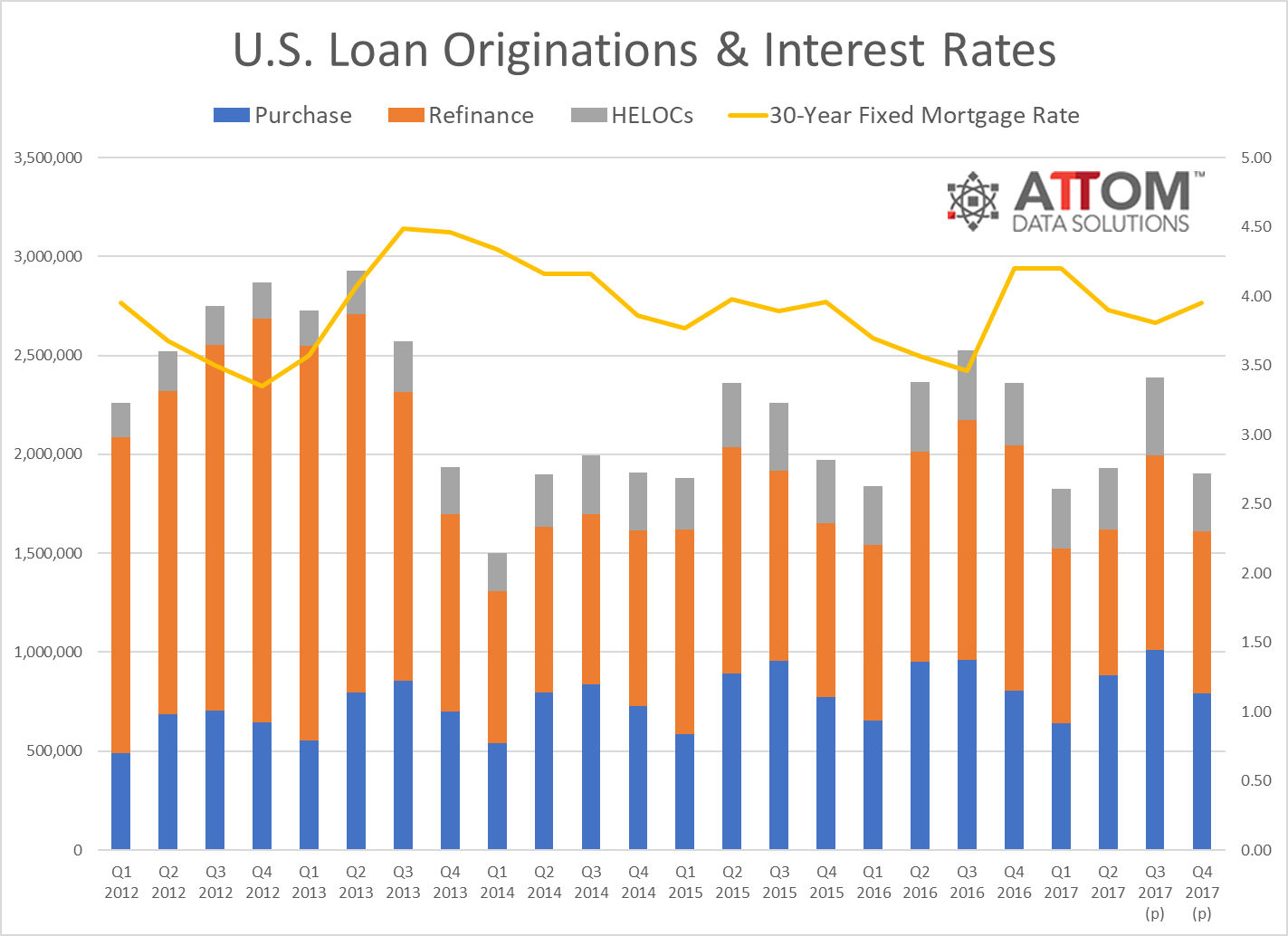

The fourth quarter of 2017 saw the origination of 1.9 million loans secured by residential property, a 20 percent plunge from the previous quarter and a 19 percent tumble from a year earlier, according to new statistics from ATTOM Data Solutions.

During the fourth quarter, 818,158 refinance loans were originated, down 17 percent from the previous quarter and down 34 percent from a year ago. The fourth quarter also saw 791,637 residential loans originated, down 22 percent from the previous quarter and down one percent from a year ago, while 293,570 home equity lines of credit were originated, down 25 percent from a nine-year high in the previous quarter and down seven percent from a year ago.

The median downpayment on single family homes and condos purchased with financing in the fourth quarter was $18,000, down from a record high $19,100 in the previous quarter, but up 20 percent from $14,950 from the previous year. The metro areas with biggest median down payments in the fourth quarter were all based in California: San Jose ($268,000), San Francisco ($174,500), Santa Rosa ($123,450), Los Angeles ($119,800) and Ventura.

“The falloff in refinance originations continued for the third straight quarter, but purchase originations held steady compared to a year ago despite ballooning downpayment amounts that make it more difficult for first-time homebuyers to compete, as evidenced by the three-year low in the share of FHA buyers,” said Daren Blomquist, Senior Vice President at ATTOM Data Solutions. “And while the rise in construction loans in part reflects homeowners reconstructing in the wake of hurricane Harvey in southeast Texas, the widespread rise in construction loans in other parts of the country indicates that more homeowners are staying put and remodeling rather than trying to move up into another home that comes with a big down payment and probably a higher mortgage interest rate.”

Separately, CoreLogic is reporting homeowners with mortgages experienced a 12.2 percent year-over-year equity increase in the fourth quarter, a gain of $908.4 billion since the fourth quarter of 2016. On average, homeowners also gained more than $15,000 in home equity between the fourth quarter of 2016 and the fourth quarter of 2017, with the greatest regional increases in Washington (an average gain of approximately $40,000 in home equity) and California (an average of approximately $44,000 in home equity).

From the third quarter of 2017 to the fourth quarter of 2017, the total number of mortgaged homes in negative equity decreased one percent to 2.5 million homes, or 4.9 percent of all mortgaged properties. On a year-over-year measurement, negative equity fell by 21 percent from 3.2 million homes, or 6.3 percent of all mortgaged properties, in the fourth quarter of 2016.

“Home-price growth has been the primary driver of home-equity wealth creation,” said Frank Nothaft, Chief Economist for CoreLogic. “The CoreLogic Home Price Index grew 6.2 percent during 2017, the largest calendar-year increase since 2013. Likewise, the average growth in home equity was more than $15,000 during 2017, the most in four years. Because wealth gains spur additional consumer purchases, the rise in home-equity wealth during 2017 should add more than $50 billion to U.S. consumption spending over the next two to three years.”

About the author