Advertisement

Mortgage Rates, Loan Defect Levels Remain Steady

Mortgage rates were slightly lower from last week and loan defect levels remained unchanged from the previous reports, according to two new data reports.

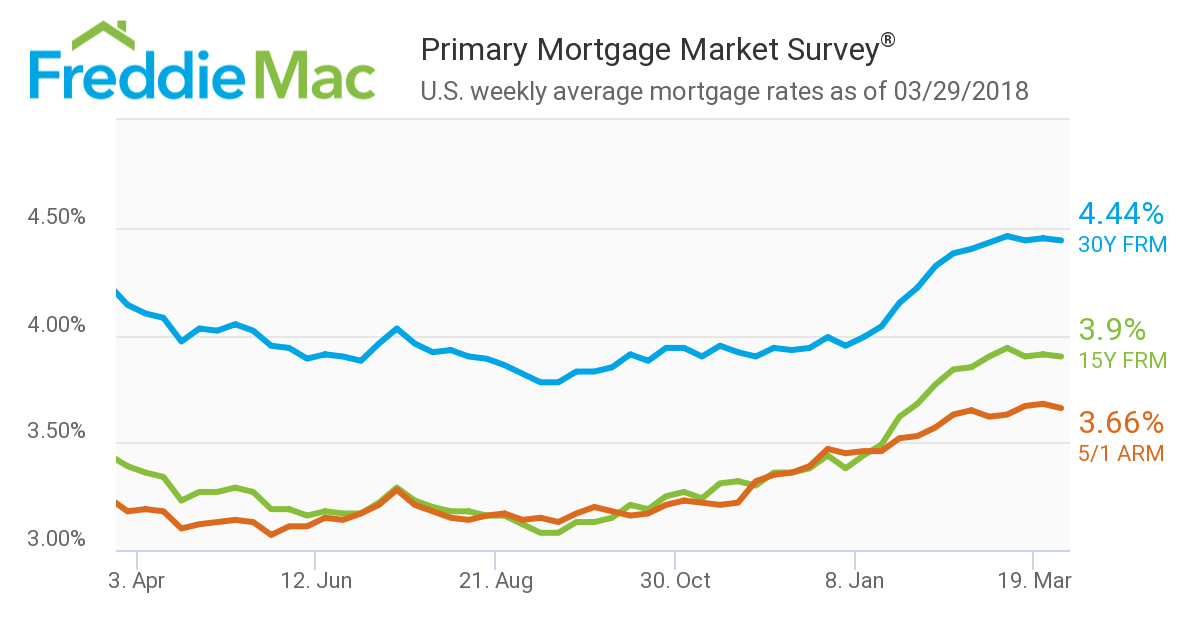

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) found the 30-year fixed-rate mortgage (FRM) averaged 4.44 percent for the week ending March 29, down from last week when it averaged 4.45 percent. The 15-year FRM this week averaged 3.90 percent, down from last week when it averaged 3.91 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.66 percent this week, down from last week when it averaged 3.68.

Separately, the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage applications during February remained the same compared with the previous month, according to the latest First American Loan Application Defect Index. On a year-over-year basis, the Defect Index increased by 9.2 percent.

February’s Defect Index for refinance transactions remained unchanged compared to January and was 13.1 percent higher than a year ago. The Defect Index for purchase transactions decreased by 1.1 percent compared with the previous month and is up 7.1 percent compared with a year ago.

Mark Fleming, Chief Economist at First American, expressed concern that the rise in the 30-year fixed-rate mortgage would spur new problems.

“This matters for defect, fraud and misrepresentation risk as rising mortgage rates reduce the benefit of refinancing and increase the share of purchase loan transactions in the market,” Fleming said. “As we have noted before, purchase loan transactions are riskier than refinance transactions.”

“This matters for defect, fraud and misrepresentation risk as rising mortgage rates reduce the benefit of refinancing and increase the share of purchase loan transactions in the market,” Fleming said. “As we have noted before, purchase loan transactions are riskier than refinance transactions.”

About the author