Advertisement

Study: California Offers the Least Affordable Housing Markets

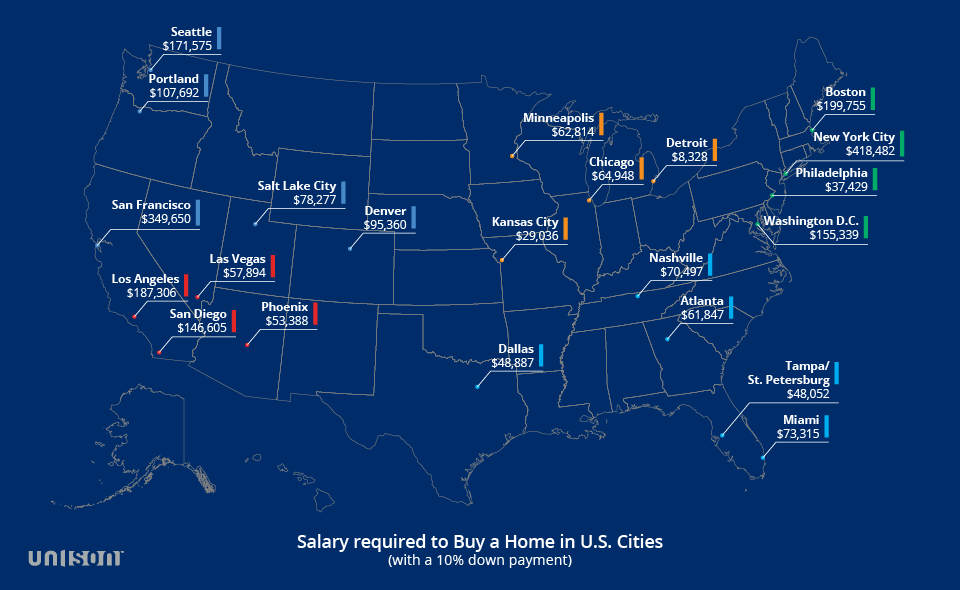

Potential homeowners in search of affordable residential properties will have a tough time if they are hunting in California, according to the 2018 Home Affordability Report issued by San Francisco-based Unison Home Ownership Investors.

The report, which analyzed the nation’s 22 largest metro areas, determined that the least affordable metros in the country are all in California. These include the San Francisco-Oakland-Hayward metro area, where an annual salary of $231,000 is needed to buy the median home with a 10 percent down payment, along with the Los Angeles-Long Beach-Anaheim market, where a salary of $157,000 is required, and the San Diego-Carlsbad market, where a salary of $139,000 is required.

On the flip side, the Midwest had the most affordable metros, including Michigan’s Detroit-Warren-Dearborn market, where an annual salary of $35,000 is needed to buy the median home with a 10 percent down payment, and Kansas City, where a salary of $41,000. Florida’s Tampa-St. Petersburg-Clearwater was also affordable: a salary of $44,000 is needed to buy a median home with a 10 percent downpayment.

“We hope to make the process easier and more manageable by providing data and insights that help identify city and neighborhood options based on their budgets,” said Benjamin Feldman, Director of Content at Unison.

About the author