Advertisement

Mortgage Rates Hold Steady While Applications Slip

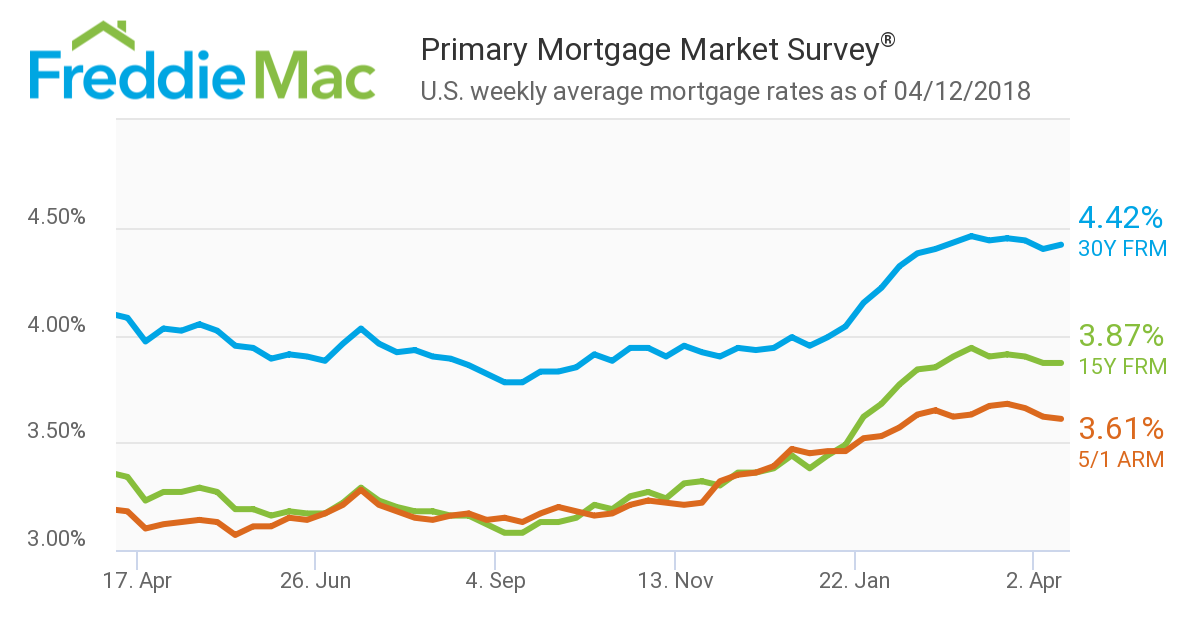

Average mortgage rates remained steady in the latest data report issued by Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.42 percent for the week ending April 12, up from last week when it averaged 4.40 percent. The 15-year FRM this week averaged 3.87 percent, the same level as last week. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.61 percent this week, down slightly from last week when it averaged 3.62 percent.

“If inflation continues to trend higher, we may see two or three more rate hikes from the Fed this year, and mortgage rates could follow,” said Len Kiefer, Freddie Mac’s Deputy Chief Economist. “For now, mortgage rates are still quite low by historical standards, helping to support homebuyer affordability as the spring homebuying season ramps up.”

Separately, the Mortgage Bankers Association’s (MBA) latest Builder Application Survey (BAS) found mortgage applications for new home purchases in March were 2.6 percent lower from the March 2017 level, but were 14 percent higher than February’s level.

The MBA estimated new single-family home sales were running at a seasonally adjusted annual rate of 682,000 units in March, which is 7.9 percent higher than the February pace of 632,000 on an adjusted measurement. On an unadjusted basis, the MBA estimated that there were 65,000 new home sales in March 2018, an increase of 18.2 percent from 55,000 new home sales in February. The average loan size of new homes decreased from $338,078 in February to $337,597 in March, and conventional loans were the dominant product during the month with 71.2 percent of the market share.

“Applications taken for new home purchases decreased year over year in March,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “We saw a strong January and February, and that may have pulled some activity forward. We did, however, see the third straight month over month increase, which is in line with the typical seasonal pattern at this time of the year. Our estimate of new home sales for March was 682,000 units, a rebound of almost 8 percent after a February decrease.”

About the author