Advertisement

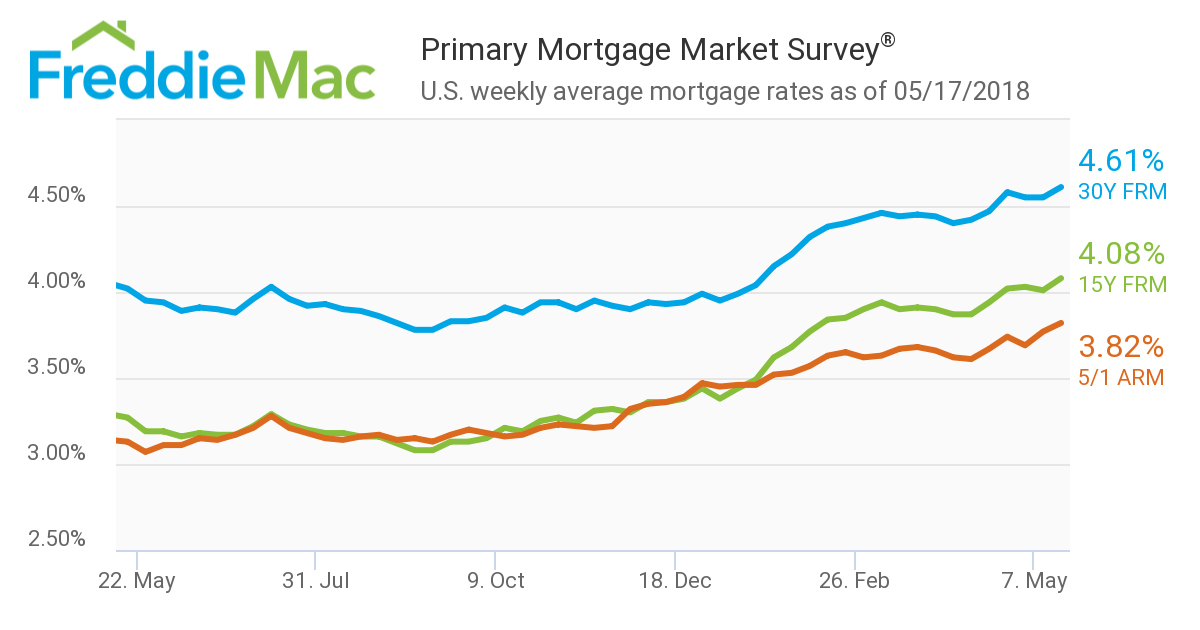

Mortgage Rates Hit Seven-Year High

The 30-year fixed mortgage rate reached a level not seen since May 19, 2011, according to new data from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.61 percent for the week ending May 17, up from last week when it averaged 4.55 percent. The 15-year FRM this week averaged 4.08 percent, up from last week when it averaged 4.01 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.82 percent this week, up from last week when it averaged 3.77 percent.

“Healthy consumer spending and higher commodity prices spooked the bond markets and led to higher mortgage rates over the past week,” said Freddie Mac Chief Economist Sam Khater. “Not only are buyers facing higher borrowing costs, gas prices are currently at four-year highs just as we enter the important peak home sales season. While this year’s higher mortgage rates have not caused much of a ripple in the strong demand levels for buying a home seen in most markets, inflationary pressures and the prospect of rates approaching five percent could begin to hit the psyche of some prospective buyers.”

About the author