Advertisement

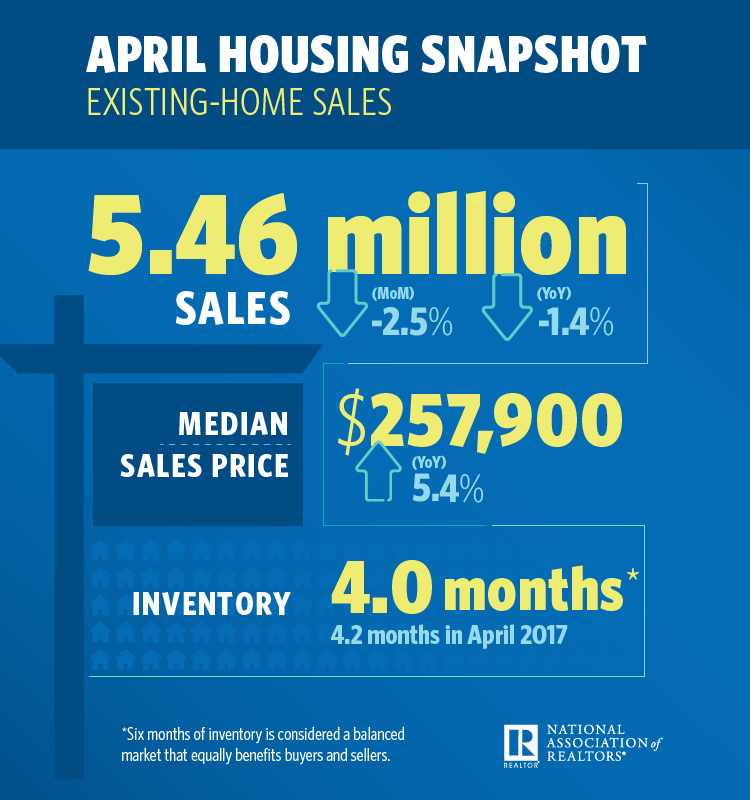

Existing-Home Sales Slip in April

Existing-home sales fell by 2.5 percent to a seasonally adjusted annual rate of 5.46 million in April from 5.60 million in March, according to new data from the National Association of Realtors (NAR). Sales are also 1.4 percent lower than one year ago and dropped on a year-over-year measurement for two straight months.

But while sales are down, prices are not. The median existing-home price for April was $257,900, up 5.3 percent from the $245,000 level set one year earlier. This marks the 74th straight month of year-over-year gains.

Also rising was the total housing inventory, which increased 9.8 percent to 1.80 million existing homes available for sale from March. However, inventory is 6.3 percent lower than a year ago (1.92 million) and has been falling on an annualized basis for 35 consecutive months.

“The root cause of the underperforming sales activity in much of the country so far this year continues to be the utter lack of available listings on the market to meet the strong demand for buying a home,” said Lawrence Yun, NAR’s Chief Economist. “Realtors say the healthy economy and job market are keeping buyers in the market for now even as they face rising mortgage rates. However, inventory shortages are even worse than in recent years, and home prices keep climbing above what many home shoppers are able to afford.”

About the author