Advertisement

Mortgage Rates Up, Purchase Applications Down

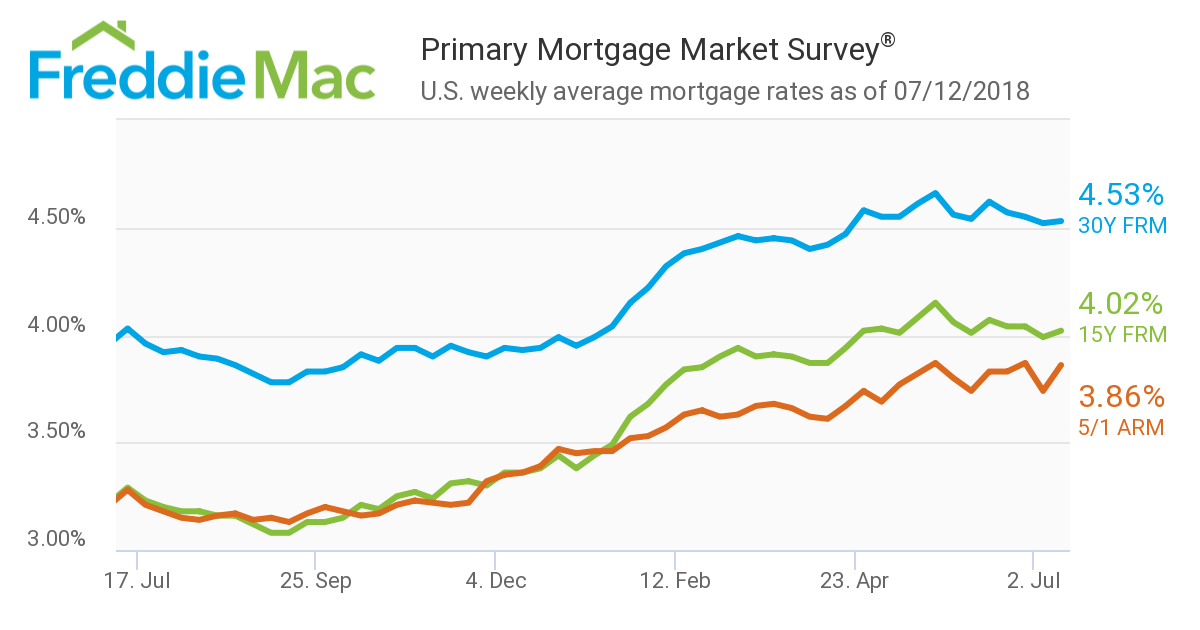

Mortgage rates were slightly higher this week according to Freddie Mac, but the level of mortgage applications for new home purchases during June took a tumble.

The 30-year fixed-rate mortgage (FRM) averaged 4.53 percent for the week ending July 12, up from last week when it averaged 4.52 percent. The 15-year FRM this week averaged 4.02 percent, up from last week when it averaged 3.99 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.86 percent this week, up from last week when it averaged 3.74 percent.

“The 10-year Treasury yield continues to hover along the same narrow range, as increased global trade tensions are causing investors to take a cautious approach,” said Sam Khater, Freddie Mac’s Chief Economist. “This, in turn, has kept borrowing costs at bay, which is certainly welcoming news for those looking to buy a home before the summer ends. A record number of people quit their job last month, most likely for a new opportunity with higher wages and better benefits. This positive trend, along with these lower mortgage rates, should increasingly give some previously priced-out prospective homebuyers the financial wherewithal to resume their home search.”

Separately, the Mortgage Bankers Association’s (MBA) Builder Applications Survey data for June found shows mortgage applications for new home purchases were down by 8.8 percent from one year earlier and were also down by 12 percent from the previous month. The MBA estimated new single-family home sales were running at a seasonally-adjusted annual rate of 587,000 units in June, down 6.2 percent from the May pace of 626,000 units. On an unadjusted basis, the MBA estimated that there were 53,000 new home sales in June, a decrease of 11.7 percent from 60,000 new home sales in May.

The average loan size of new homes decreased from $337,515 in May to $333,033 in June. By product type, conventional loans dominated the with a 71.3 percent share of loan applications, followed by FHA loans at 15.9 percent, VA loans at 11.6 percent and RHS/USDA loans at 1.1 percent.

For the year-to-date, the MBA noted that new home applications are up 2.5 percent compared to the same period in 2017.

“Our sense is that builders remain constrained by the tight job market for construction labor and rising input costs, particularly lumber costs,” said Mike Fratantoni, MBA Chief Economist and Senior Vice President of Research and Industry Technology.

About the author