Advertisement

New Studies Consider When and Where to Buy a Home

Two new studies have considered the homebuying process: one debates the right age to pursue a first-time home purchase and the other examines whether the prospective buyer can afford the property.

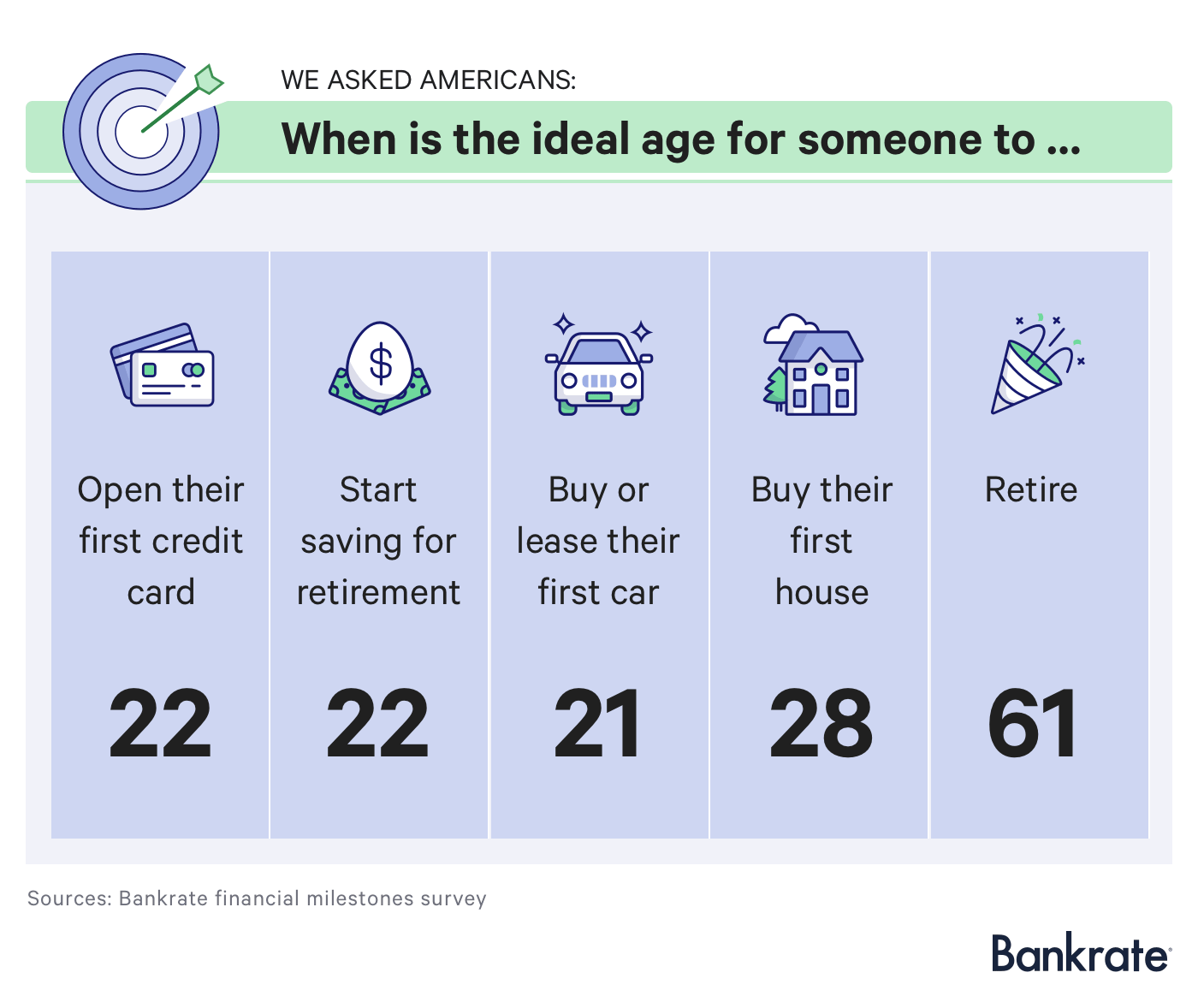

When it comes to being in the right place at the right time, it often helps if one is also at the right age. According to a new study from Bankrate, most U.S. adults believe that 28 is the ideal age for buying a first home.

However, there are differences of opinion on first-time homebuying based on gender: One-quarter of adult males think that 25 is the right age to dive into homebuying, while only 12 percent of women felt 25 was the perfect time. Those living in the Northeast were less eager to rush into the process: nearly one in five, or 18 percent, felt that the right age for first-time homebuying was 35 or higher.

But there is another concern: is it possible to afford a new home, especially in today’s increasingly expensive market? Finder.com studied 78 major metro areas to determine the salary needed to own and maintain a home, and it found San Francisco topped the list for the highest required salary, with a prospective homeowner needing to make $221,931 a year to buy an average home costing $1.33 million. San Jose came second place with a salary of $179,616 to afford a $1.08 million home. Finder.com also noted U.S. Census Bureau data that the median wage in 2016 was $57,230, which meant that those earning that sum would only be able to pursue homeownership in 17 of the 78 cities surveyed for the report.

“Understanding the financial obligations and the job opportunities in a city of interest are a great starting point when deciding whether or not to make a place your forever home,” Jennifer McDermott, Consumer Advocate at Finder.com. “You should always compare salaries within the city against the costs of living, otherwise you run the risk of placing you and your family in a financial bind. With research revealing average home loan interest rates have slightly risen in the past 12 months, it’s more important than ever to research and compare home loans options within the city you wish to live, and understand the current trends among the housing industry.”

About the author