Advertisement

Mortgage Rates Continue to Climb

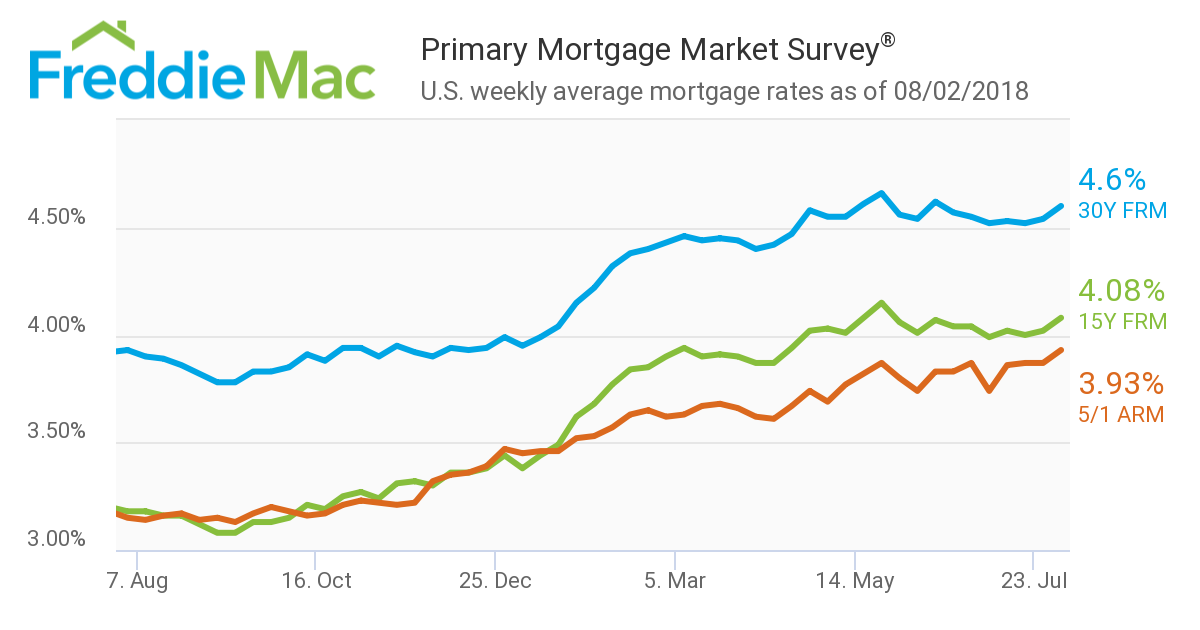

Freddie Mac has released the results of its latest Primary Mortgage Market Survey (PMMS), showing that mortgage rates over the past week jumped to their fourth highest level of the year.

The 30-year fixed-rate mortgage (FRM) averaged 4.60 percent with an average 0.4 point for the week ending Aug. 2, 2018, up from last week when it averaged 4.54 percent. A year ago at this time, the 30-year FRM averaged 3.93 percent. The 15-year FRM this week averaged 4.08 percent with an average 0.4 point, up from last week when it averaged 4.02 percent. A year ago at this time, the 15-year FRM averaged 3.18 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.93 percent with an average 0.2 point, up from last week when it with an average 3.87 percent. A year ago at this time, the five-year ARM averaged 3.15 percent.

“The higher rate environment, coupled with the ongoing lack of affordable inventory, has led to a drag on existing-home sales in the last few months,” said Sam Khater, Freddie Mac’s Chief Economist. “Yesterday, the Federal Reserve passed on raising short-term rates, but with the embers of a strong economy potentially stoking higher inflation, borrowing costs will likely modestly rise in coming months. Even with home price growth easing slightly in some markets, mortgage rates hovering near a seven-year high will certainly create affordability challenges for some prospective buyers looking to close.”

About the author