Advertisement

Mortgage Rates and Delinquency Rates Down

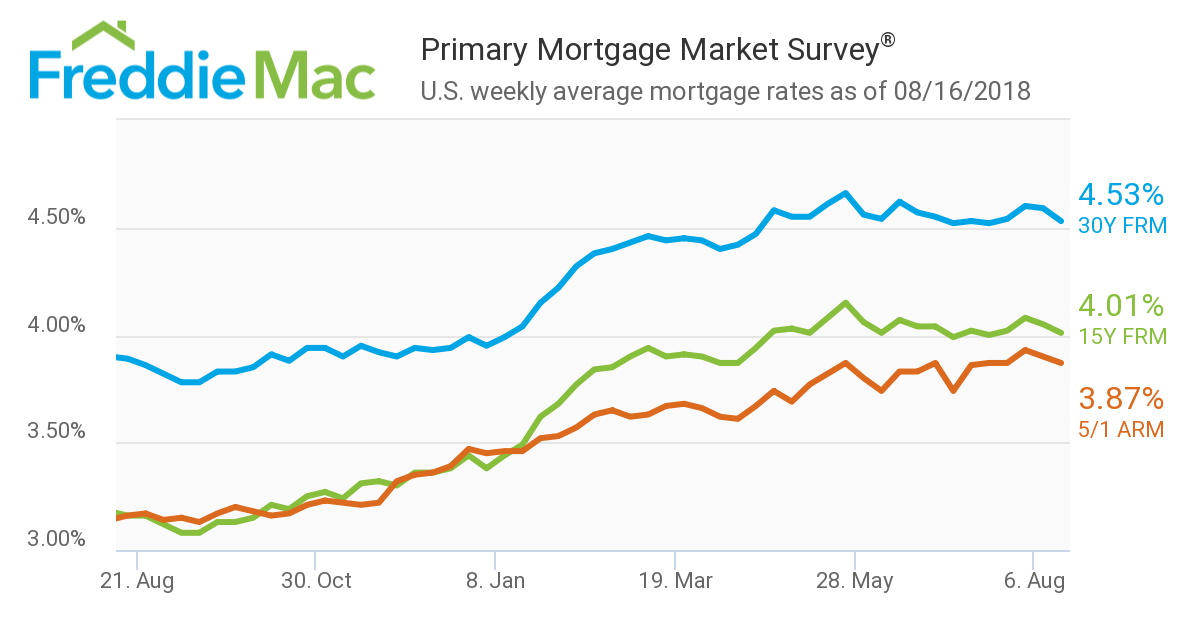

Mortgage rates were down again for the second consecutive week, according to new data from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.53 percent for the week ending Aug. 16, down from last week when it averaged 4.59 percent. The 15-year FRM this week averaged 4.01 percent, down from last week when it averaged 4.05 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.87 percent, down from last week when it with an average 3.90 percent.

“This stability in borrowing costs comes despite the highest core inflation rates since 2008 and turbulence in the currency markets,” said Sam Khater, Freddie Mac’s Chief Economist. “Unfortunately, this pause in rates is not leading to increasing home sales. Purchase mortgage applications trailed year ago levels again last week, and it’s clear that in some markets the combination of ascending home prices, limited affordable inventory and this year’s higher rates are curtailing homebuyer demand.”

Separately, the Mortgage Bankers Association reported the delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 4.36 percent of all loans outstanding at the end of the second quarter. The delinquency rate was 27 basis points lower than the previous quarter, but was up 12 basis points from one year ago. The percentage of loans on which foreclosure actions were started dropped four basis points from the last quarter to 0.24 percent, its lowest level since the second quarter of 1987.

About the author