Advertisement

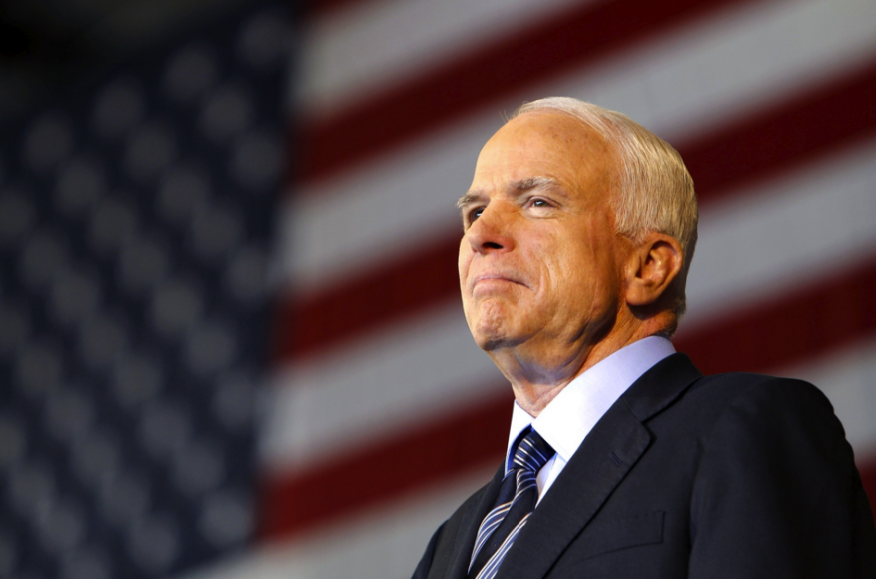

Retrospect: John McCain and the S&L Scandal

During his career on Capitol Hill, Sen. John McCain was rarely in the forefront of housing-related policy issues. And while news coverage following his death on Saturday focused on his military career and his self-applied “maverick” personality, relatively little attention was recalled on McCain’s involvement in a major scandal involving the savings and loan industry.

McCain was one of five senators dubbed the Keating Five, who were accused of corruption for their efforts to improperly intervene with a 1987 Federal Home Loan Bank Board regulatory investigation of Charles H. Keating Jr., Chairman of the Lincoln Savings and Loan Association, which was the target of a regulatory investigation by the Federal Home Loan Bank Board (FHLBB). Lincoln Savings and Loan collapsed in 1989, which cost the federal government $3.4 billion to the federal government.

McCain, who frequently advocated for bipartisanship during his Capitol Hill years, was the sole Republican in the Keating Five—the others were Alan Cranston of California, Dennis DeConcini of Arizona, John Glenn of Ohio and Donald W. Riegle Jr. of Michigan. Keating contributed a total of $1.3 billion to the five senators, with McCain receiving $112,000 from the thrift executive along with nine free trips paid by Keating. McCain’s second wife Cindy and her father were also investors in a Keating shopping center development.

In 1991, the Senate Ethics Committee investigation concluded that McCain showed "poor judgment" in his dealings with Keating, but did not engage in any criminal activity. Information from the closed-door committee hearings was leaked to the press—although McCain denied he was responsible for the leaks, an investigator with the Government Accountability Office would state, "There is absolutely no doubt in my mind that McCain made those leaks."

McCain would later comment on his involvement with Keating by stating his efforts to influence regulators was "the worst mistake of my life."

About the author