Advertisement

New Data Forecasts Potential Florence Destruction

A series of new data reports are offering a dismal picture of the damage being created by Hurricane Florence, which made landfall this morning along the North Carolina and South Carolina coasts.

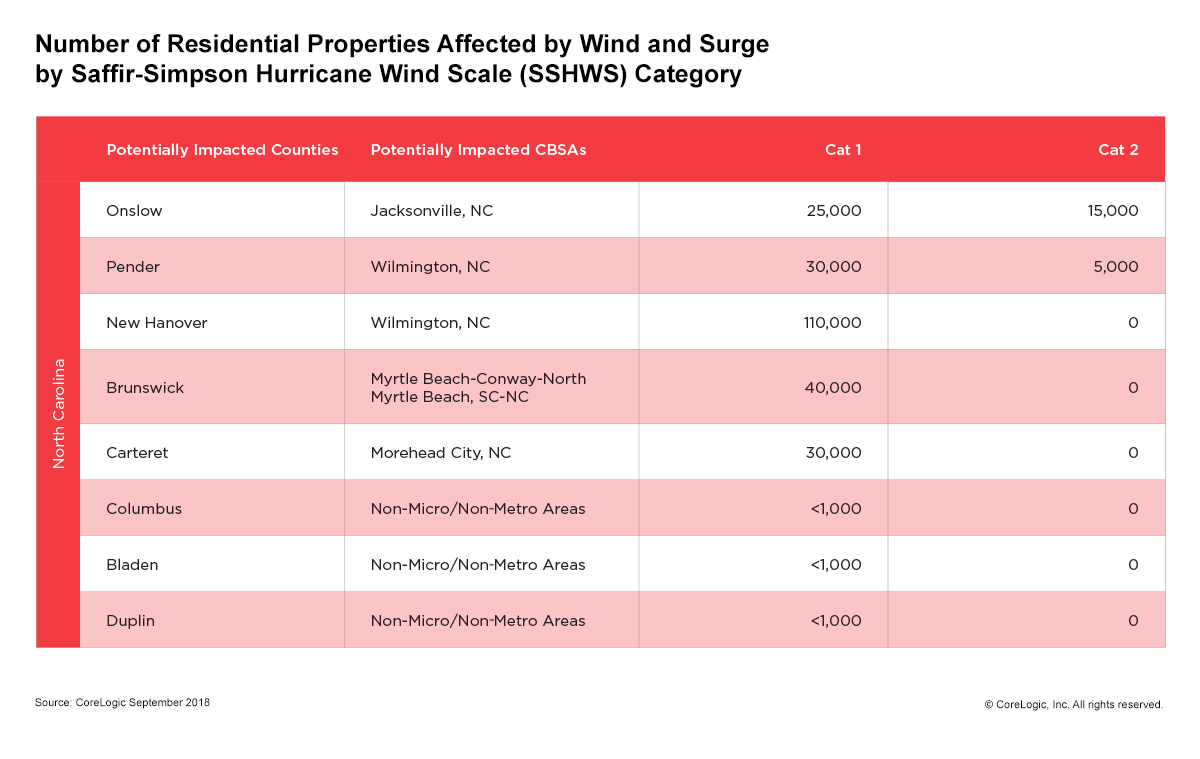

CoreLogic is estimating between $3 billion and $5 billion in losses for residential and commercial properties in this region, with 250,000 homes in North Carolina projected to be impacted by the hurricane. However, that range does not include insured losses related to rainfall, riverine or other flooding that is expected to occur. CoreLogic noted that 250,000 homes in North Carolina are projected to be impacted by the hurricane.

Danielle Hale, Chief Economist at Realtor.com, stated that damage from the hurricane will be felt in housing-related data. Hale added that the coastal markets make up a significant portion of the Carolina real estate markets, accounting for 39 percent of the nearly 96,000 homes currently for sale in the two states.

“Damage from Hurricane Florence is likely to disrupt national home sales and construction for months to come,” Hale said. “In August, homes in the Carolinas accounted for nearly six percent of homes for-sale in the U.S. Expected rainfall from the hurricane will damage properties in more than just the coastal areas and likely result in a dampening of national housing trends.”

And Kroll Bond Rating Agency (KBRA) noted that the Carolinas accounted for 4.18 percent of the collateral backing KBRA’s rated RMBS 2.0 portfolio. However, the Agency added that the potential impact of Florence to coastal areas include only 0.76 percent of the collateral from properties backing KBRA’s rated RMBS portfolio.

About the author