Advertisement

Existing-Home Sales Hold Steady

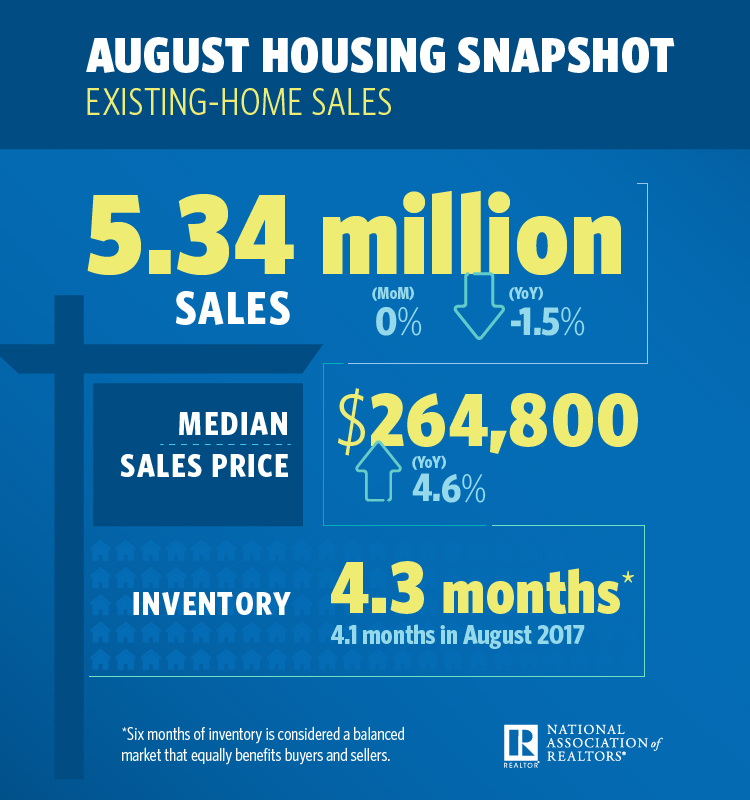

Total existing-home sales were unchanged from July to August and remained at a seasonally adjusted rate of 5.34 million in August, according to new data from the National Association of Realtors (NAR). However, sales are now down 1.5 percent from the 5.42 million let set in August 2017.

Also remaining unchanged from July to August was the total housing inventory, which held steady at 1.92 million existing homes available for sale. However, that number is higher than the 1.87 million level from August 2017. August’s unsold inventory is at a 4.3-month supply at the current sales pace, the same as in July and up from 4.1 months a year ago.

Furthermore, all-cash sales were 20 percent of transactions in August, unchanged from July and a year ago. Distressed sales accounted for three percent of transactions in, August unchanged from the previous month and down from four percent a year ago. This was the lowest level of distressed sales in the 10 years that NAR has been tracking this activity.

One area where there was change involved pricing. The median existing-home price for all housing types in August was $264,800, up 4.6 percent from $253,1000 in one year earlier. August marks the 78th straight month of year-over-year gains.

“While inventory continues to show modest year over year gains, it is still far from a healthy level and new home construction is not keeping up to satisfy demand,” said NAR Chief Economist Lawrence Yun. “Homes continue to fly off the shelves with a majority of properties selling within a month, indicating that more inventory—especially moderately priced, entry-level homes—would propel sales. Rising interests rates along with high home prices and lack of inventory continues to push entry-level and first time home buyers out of the market. Realtors continue to report that the demand is there—that current renters want to become homeowners—but there simply are not enough properties available in their price range.”

About the author