Advertisement

Home Equity Levels Rise in Q2

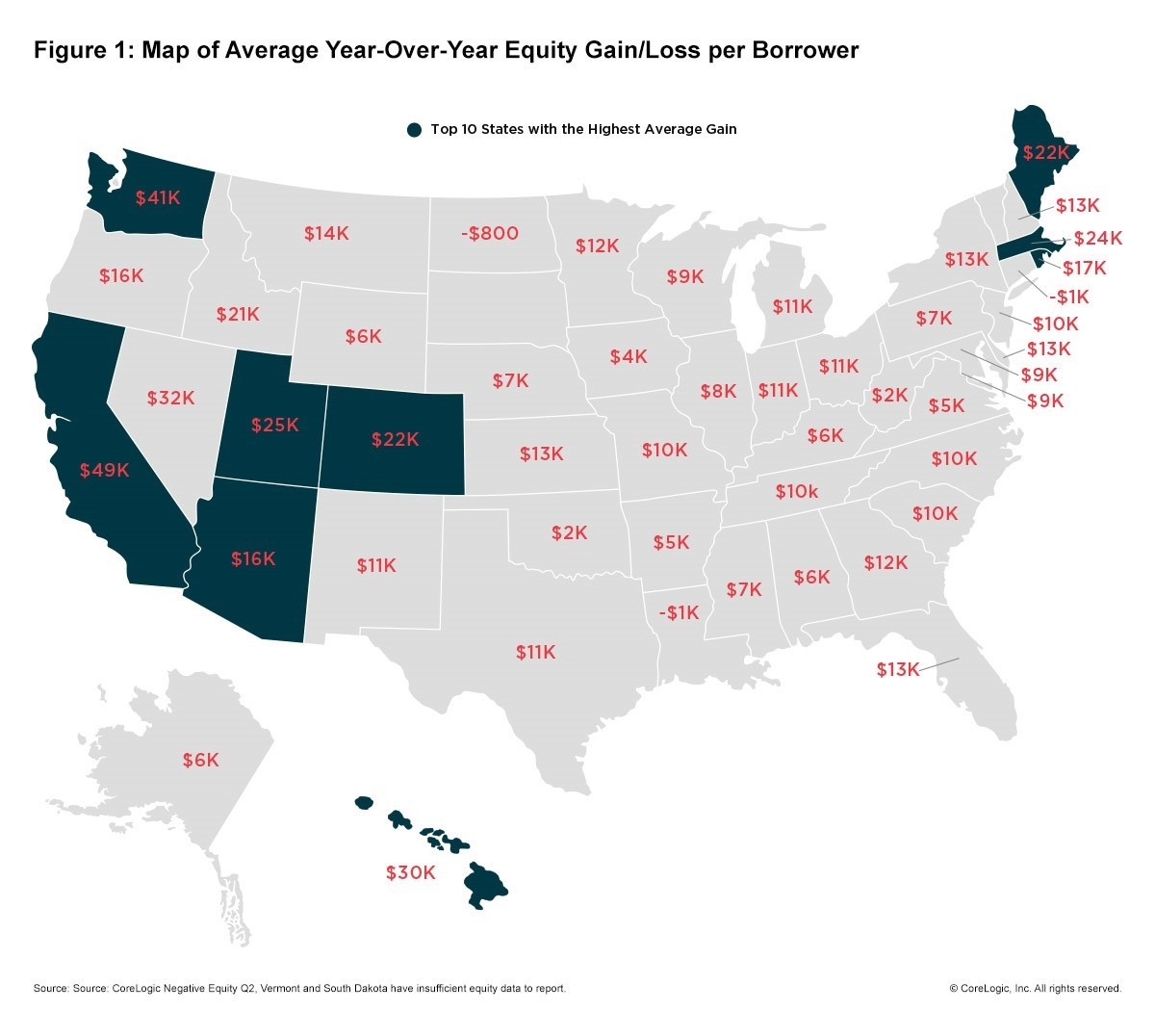

Homeowners with mortgages saw a 12.3 percent increase in their equity between the second quarters of 2017 and 2018, according to data from CoreLogic. For the average homeowner, this represented a gain of $16,200.

Perhaps not surprisingly, the pricey West Coast markets experienced the greatest equity gains. California homeowners pocketed an average of approximately $48,800 in home equity and Washington homeowners experienced an average increase of approximately $41,100 in home equity over the 12-month period analyzed by CoreLogic.

Also, the total number of mortgaged homes in negative equity decreased nine percent to 2.2 million homes, or 4.3 percent of all mortgaged properties, between the first and second quarters of this year. On an annualized measurement, the number of mortgaged properties in negative equity fell 20.1 percent from 2.8 million homes, or 5.4 percent of all mortgaged properties, in the second quarter. The national aggregate value of negative equity was approximately $279.8 billion at the end of the second quarter, down from $285.3 billion in the first quarter.

“Negative equity levels continue to drop across the US with the biggest declines in areas with strong price appreciation,” said Frank Martell, President and Chief Executive Officer of CoreLogic. “Further, the relatively low level of shadow inventory contributes to the chronic shortage of housing supply and price increases in many markets.”

About the author