Advertisement

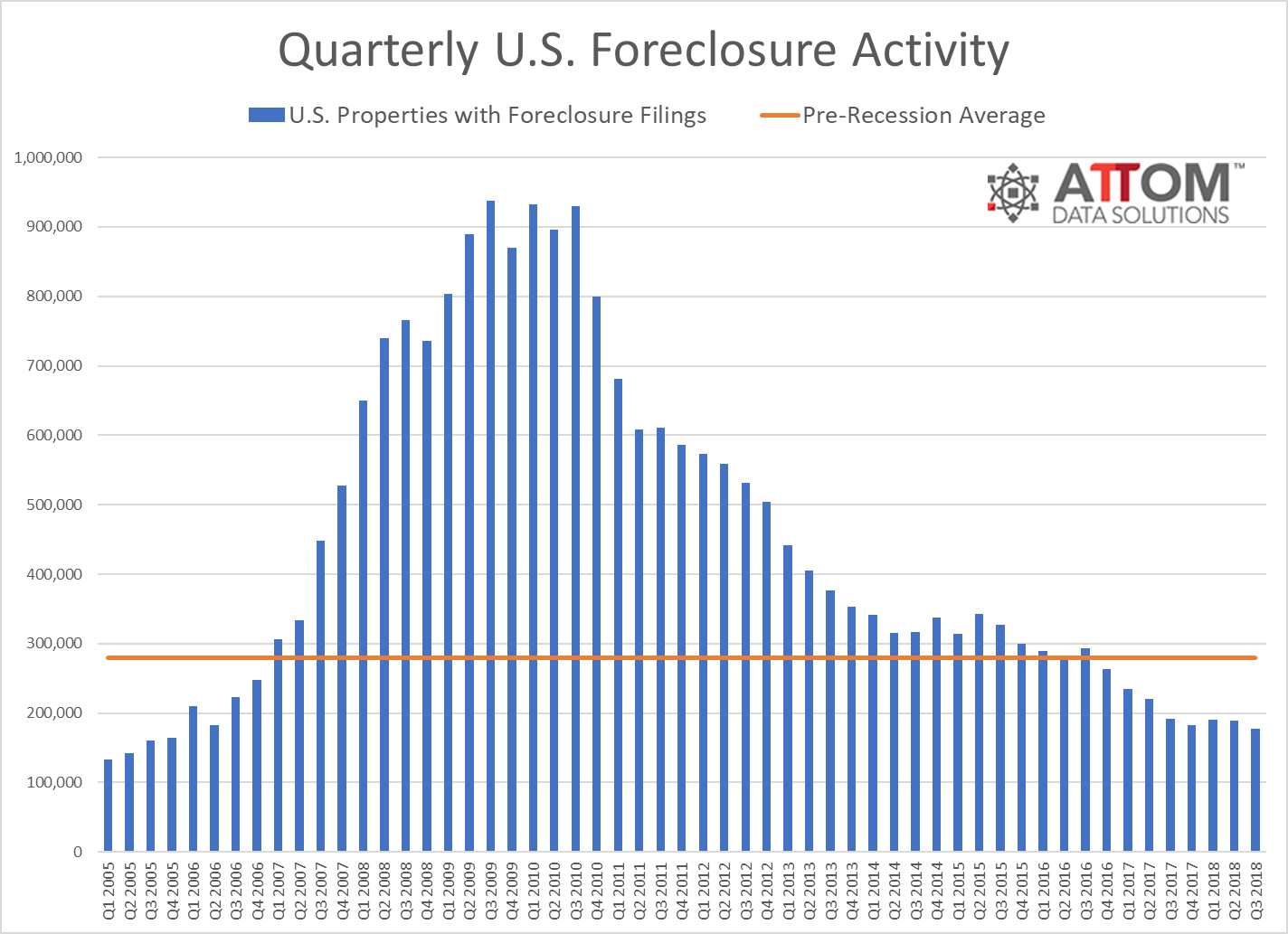

Foreclosure Activity at 13-Year Low

A total of 177,146 properties carried foreclosure filings in the third quarter, down six percent from the previous quarter and down eight percent from a year ago to the lowest level since the fourth quarter of 2005, according to a new report from ATTOM Data Solutions. The third quarter was also the eighth consecutive quarter where foreclosure activity has registered below the pre-recession average of 278,912 properties.

Lenders began the foreclosure process on 91,849 properties in third quarter, down six percent from the previous quarter and down three percent from a year ago. This marked the 13th consecutive quarter with a year-over-year decrease in foreclosure starts. However, 15 states posted year-over-year increases in foreclosure starts, most notably Michigan (up 32 percent) and Florida (up 25 percent), while 79 of the top 219 metro areas analyzed in the report year-over-year increases, most notably Detroit (up 65 percent) and Houston (up 51 percent).

“A decade after poorly underwritten mortgages triggered a housing market crash, it’s clear that the foreclosure risk associated with those problem mortgages has faded—average foreclosure timelines have dropped to a two-year low, and the share of foreclosures tied to 2004-to-2008 loans has dropped well below 50 percent,” said Daren Blomquist, Senior Vice President at ATTOM Data Solutions. “The biggest foreclosure risk in today’s housing market comes from natural disaster events such as the twin hurricanes of a year ago. Foreclosure starts spiked in the third quarter in many local markets impacted by those hurricanes. Secondarily, we are seeing relatively modest—but more widespread—foreclosure risk associated with FHA loans originated in 2014 and 2015.”

About the author