Advertisement

Mortgage Delinquencies Up Sharply in September

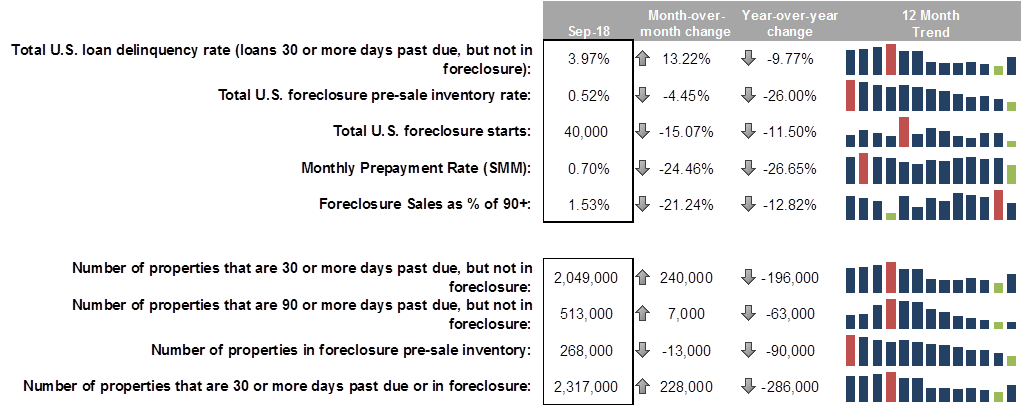

Mortgage delinquencies skyrocketed by more than 13 percent in September, the largest single-month rise since November 2008, according to new data from Black Knight. However, September tends to generate increased delinquencies: 16 of the last 19 Septembers recorded increases, averaging a 5.2 percent rise. Black Knight noted that Hurricane Florence-related delinquencies accounted for roughly 6,000 out of a 240.000 increase in delinquencies.

During September, foreclosure starts posted a double-digit monthly decline, hitting a nearly 18-year low with 40,000 for the month. Black Knight noted the inventory of loans in active foreclosure and the foreclosure rate are below their pre-recession averages for the first time since the financial crisis.

Furthermore, Black Knight reported monthly prepayment activity fell by nearly 25 percent from August to September. The company attributed this to reduced housing turnover in the face of rising interest rates and affordability pressures.

About the author