Advertisement

Mortgage Rates Up Again

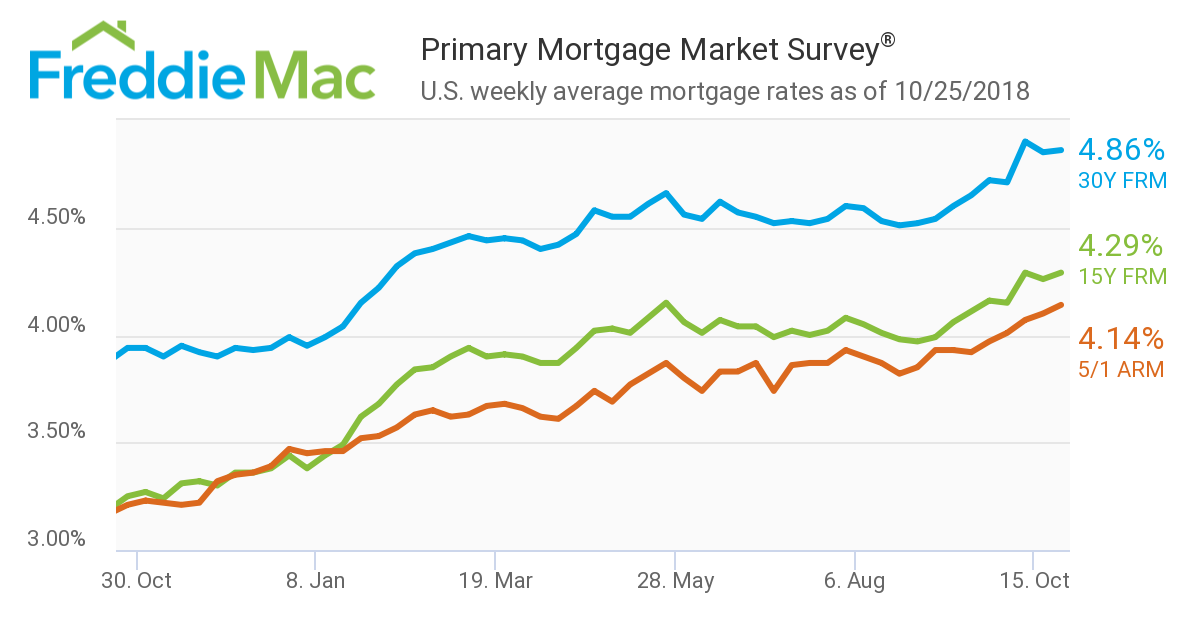

Mortgage rates were up slightly in the latest data from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.86 percent for the week ending Oct. 25, up from last week when it averaged 4.85 percent. The 15-year FRM this week averaged 4.29 percent, up from last week when it averaged 4.26 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.14 percent, up from last week when it averaged 4.10 percent.

“We expect rates to continue to rise, which will put downward pressure on homebuying activity,” said Sam Khater, Freddie Mac’s Chief Economist. “While higher borrowing costs will keep some people out of the market, buyers with more flexibility could take advantage of the decreased competition.”

Separately, the Federal Housing Finance Agency (FHFA) reported that the National Average Contract Mortgage Rate for the Purchase of Previously Occupied Homes by Combined Lenders Index was 4.62 percent for loans closed in late September, down one basis point from 4.63 percent in August, while the average interest rate on all mortgage loans was 4.63 percent, unchanged from 4.63 in August. The average interest rate on conventional, 30-year, fixed-rate mortgages of $453,100 or less was 4.77 percent, down one basis point from 4.78 in August, and the effective interest rate on all mortgage loans was 4.72 percent in September, up one basis point from 4.71 in August.

The FHFA added that the average loan amount for all loans was $306,100 in September, down $12,500 from $318,600 in August.

About the author