Advertisement

Mortgage Loan Defect Index Up for September

The frequency of defects, fraudulence and misrepresentation in mortgage applications in September increased by 1.3 percent compared with the previous month, but was down by six percent from one year ago, according to the latest data from the First American Loan Application Defect Index.

The Defect Index for purchase transactions increased by 1.3 percent, compared with the previous month, but was down by 11.1 percent compared with a year ago. The Defect Index for refinance transactions increased by 1.4 percent from August to September and remained at the same level from September 2017.

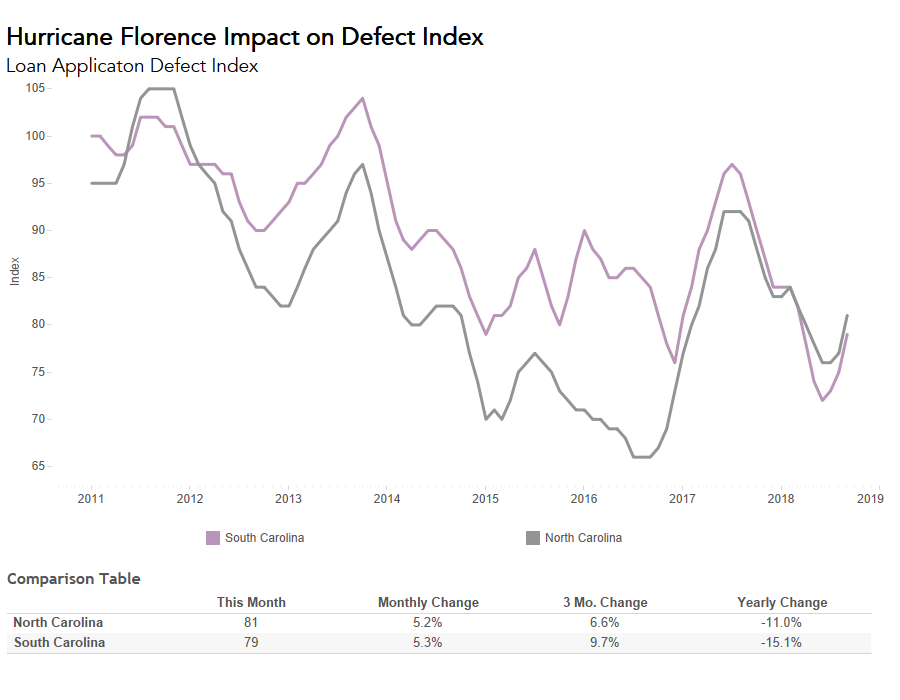

The new data also reported spikes in mortgage application defects in areas impacted by Hurricane Florence. North and South Carolina monthly increases in the Defect Index in September, up 5.3 percent and 5.2 percent respectively. The five states with the greatest year-over-year increase in defect frequency were Hawaii (9.7 percent), Maine (8.6 percent), Alaska (6.3 percent), Wyoming (4.3 percent) and California (+3.9 percent), while the five states with the greatest year-over-year decrease in defect frequency were Vermont (-19.4 percent), Minnesota (-18.6 percent), Arkansas (-17.0 percent), Alabama (-16.7 percent) and North Dakota (-15.7 percent).

About the author